04.24.2024

Biodiesel output strong in Q2; producers start locking in Q3-Q4 sales

A second producer echoed this sentiment and said they have had to work a bit harder to secure feedstock to line it up with sales at the right time.

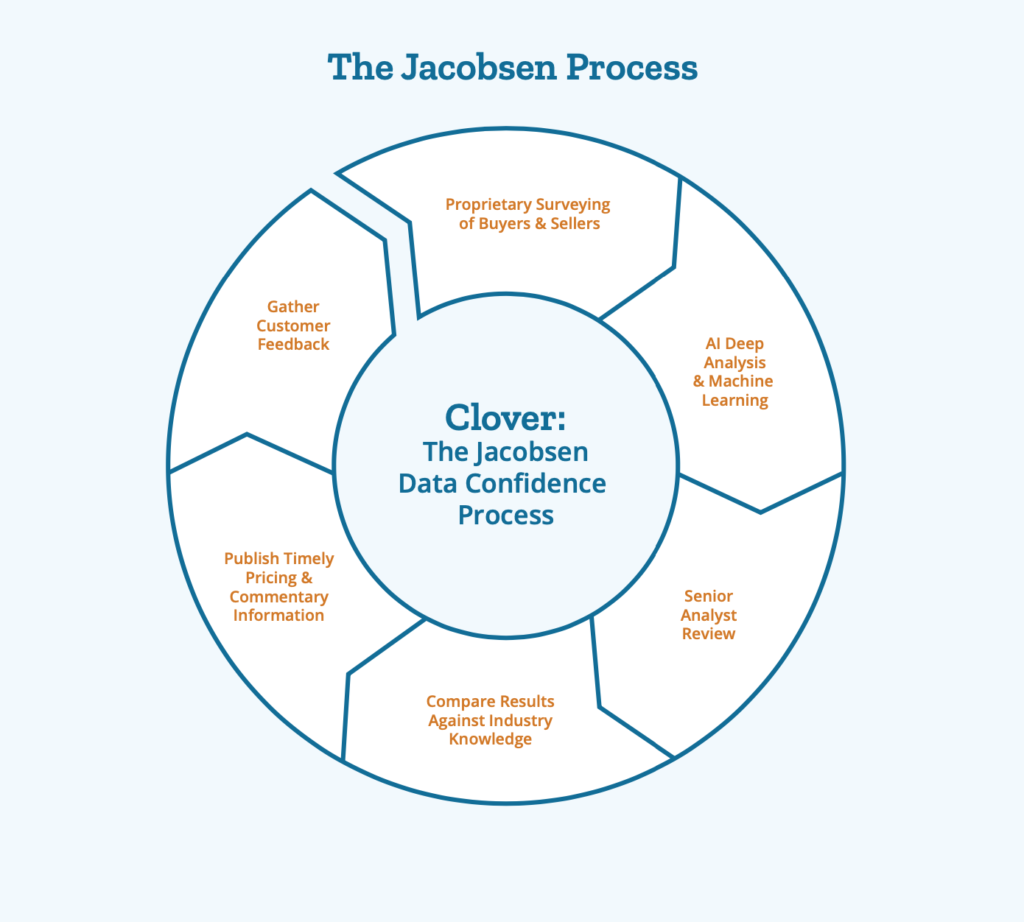

Since 1865, the Jacobsen has been the benchmark for the markets we serve. We have earned that status over the last century and a half as a result of our unbiased, rigorous, neutral position in the market.

We collect offers, bids and trades daily. Every trading day, we communicate with all segments of the market: buyers, sellers, traders and brokers in order to get a complete picture. We know the overall tone of the market, where complementary commodities are trading, which folks are perpetually bullish and which that are always bearish.

Although most of our editors come from a trading background, they do not currently trade in the markets they cover. We believe that no matter how honest and upstanding a person is, trading position will bias a trader’s perspective on the market. Therefore, we avoid any possibility of bias by not actively participating in the market.

Verification of reported prices is a function of a particular market and is carried out in a variety of ways. For example, we will talk to the other side of trade to confirm and request documentation of a trade. We always make sure that reported trades fit within the context of the market.

We review our rules and price guides annually for mature markets and more frequently for dynamic markets to make sure they are as relevant as they can be. We report the market as it is, rather than how it used to be.

The Jacobsen methodology has been established as a tool to govern the processes in which data is collected and processed for the purpose of providing timely, accurate and transparent market and price information for use as benchmarks in the agricultural commodity, biofuels and carbon credit markets. The Jacobsen uses IOSCO principles, along with an annual review from market stakeholders, in order to create a price report that is free of from distortion and representative of an economic reality within the markets reported and published.

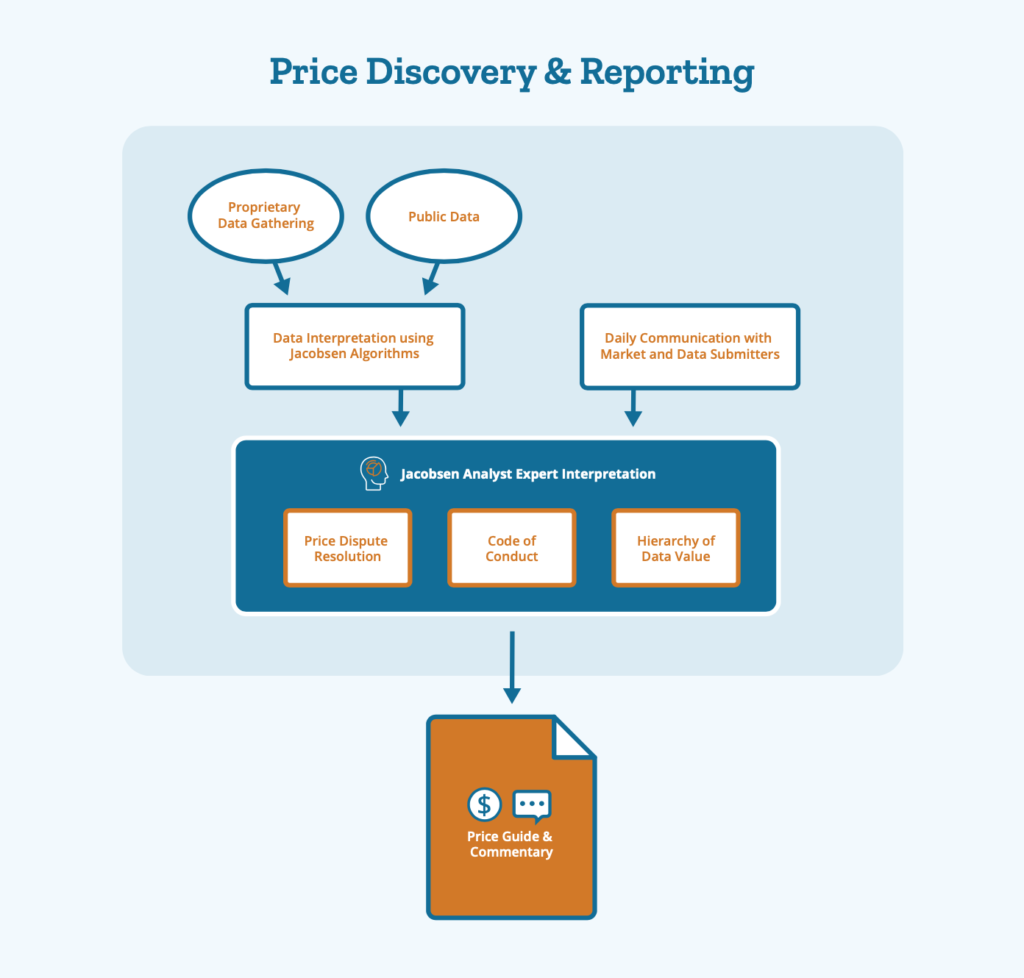

To ensure the reporting of an accurate, economic reality for these markets The Jacobsen publishes benchmark values for domestic markets on a daily (Mon- Fri) basis and for the global markets on Thursday. The price discovery is undertaken by trained members of The Jacobsen price reporting agency (PRA) team and the resulting information is filtered through our assessment guidelines to determine a fair and accurate value for the market on a given day.

Jacobsen Price Reporting Agency (PRA) team members call, email, direct message (e.g. ICE chat) buyers, sellers, brokers and traders to obtain price information from market transactions. Buyers, sellers and other parties with relevant market data are also encouraged to contact The Jacobsen PRA team members via phone, email, direct message or in face to face meetings.

Market transaction eligibility is limited to arms-length transactions, done by counterparties that are not affiliated under a common, corporate structure.

The Jacobsen maintains an internal list of market data submitters (MDS) who may report transactions or market information to members of The Jacobsen PRA team. The Jacobsen actively seeks market information from buyers and sellers as well as brokers who may be in possession of market knowledge. The Jacobsen records the results of the communications and stores in a secure database for five years.

At the end of each day (3 pm US Central), The Jacobsen PRA staff reviews the collected data and determines a price for the reported markets by assessing price and volume. Within each bulletin, The Jacobsen delineates the volume and specifications for each commodity and geography on which we report. Specific volumes and geography definitions can be found within the individual commodity descriptions. Volumes and specifications for reporting are also listed within the bulletins on The Jacobsen website.

If no trading occurs for five consecutive days in a market The Jacobsen reserves the right to unquote that market.

The Jacobsen uses the following hierarchy to determine a fair market value on a daily basis. In accordance with IOSCO principles, the hierarchy is used to measure the strength of market data submitted and in turn is used, in order, to reflect an accurate, economic reality in a given market.

Concluded transactions, done at arms-length and confirmed by counterparties or an intermediary broker are given top priority.

The majority of price reporting is done via concluded transactions and bids and offers.

Minimum volumes and specifications for reported commodities are metrics that have been agreed upon by a majority of industry participants by direct consultation and/or specifications published by a trade group.

Market data are considered current for a period of five days after an initial report, if there are no additional reports. After a period of five days of no activity in a market, The Jacobsen can remove a price quote from the price guide.

The Jacobsen maintains an internal lists of market data submitters that are continually reviewed. Market data submitters (MDS) are required to abide by the Jacobsen Market Data Submitter Code of Conduct. Violations of the Market Data Submitter Code of Conduct can result in the loss of eligibility to submit information.

In accordance with IOSCO principle 2.2e MDS are encouraged to submit data on all concluded transactions. The Jacobsen actively seeks to obtain the majority of trade data from the individuals directly involved in the transactions, but will also accept trade data from sales, procurement or marketing managers.

The Jacobsen maintains records of contact made to and received by market data submitters.

The resulting information is recorded and stored in the Jacobsen database. Information records can be, but are not limited to, copies of emails, written trade accounts and relevant information, ICE chat transcripts and copies of text messages. These records are kept for five years.

The Jacobsen also maintains a weekly contact sheet that is stored with the trade report records for five years.

Below is an example of a trade contact sheet for one day:

To mitigate any potential negative impacts of limited reports or overreliance on a few, select contributors The Jacobsen PRA staff are trained and expected to survey the market as a whole, regardless of the submitters potential market share.

The Jacobsen reserves the right to exclude reported data that it deems to fall outside of the current market reality. Reported data is processed through a set of controls in order to determine if data is representative of an economic reality in a given market.

PRA staff are required to submit the trade exclusion through a peer review process. If a price is not included in the daily reporting, the submitters will be notified, and the trade will be added to an exclusions log.

Excluded transactions that have been reported and the rationale behind the exclusion of the activity from the price guide will be published in the commentary of the respective bulletin.

Price disputes and complaints are processed through the same matrix as price exclusions and are subjected to the peer review process. Parties disputing prices must submit a review request within 24 hours of a price publication. If the price disputed is found to be in error, a change will be made to the price guide with a notification to all subscribers of the change and the reasoning behind the adjustment. Reasoning for price disputes that do not result in change to recorded values will be communicated to those disputing the price, in writing, within 24 hours of a price dispute submission.

After processing a reported transaction through the relevant process an assessor will present their findings on exclusions, disputes or large movement inclusions to the PRA director for sign off.

The PRA director will scrutinize the findings of the process and approve or resubmit to the assessor for further discovery.

Once approval is granted, the trade will be included in the price guide or excluded from reporting in the price guide, but the rationale will be printed in the daily commentary.

Any changes to The Jacobsen methodology, price guides, specifications or reporting times are first reviewed by market stakeholders. The Jacobsen maintains a list of stakeholders for each bulletin that are representative of the markets being reported. In order to prevent an injurious change, The Jacobsen seeks a majority approval from buyers and sellers in those markets.

To maintain the integrity of the price reporting methodology a review is done on annual basis. The process and timing is as follows:

Jan – June: The Jacobsen PRA staff reviews all markets reported and determines if any changes need to be made to geographies, specifications, volumes, or other details in the price guides.

July: The Jacobsen submits potential changes to stakeholders for review and comments. Stakeholder comments are made public to other stakeholders, unless they specifically request confidentiality.

August: The Jacobsen reviews the stakeholder comments, makes appropriate changes and announces to market as whole by Aug 31 for implementation on Jan 1 of following year.

The rationale behind changes and stakeholder comments are retained in a secure database for five years.

Reporting and discovery of new products and geographical additions can be added to the market reporting on a fast track process. If there is a need for additional price discovery in a given market, The Jacobsen will implement a stakeholder review over a two-week period and add discovery as needed within a one-week period at the conclusion of the review.

The rationale behind additions and stakeholder comments are retained in a secure database for five years.

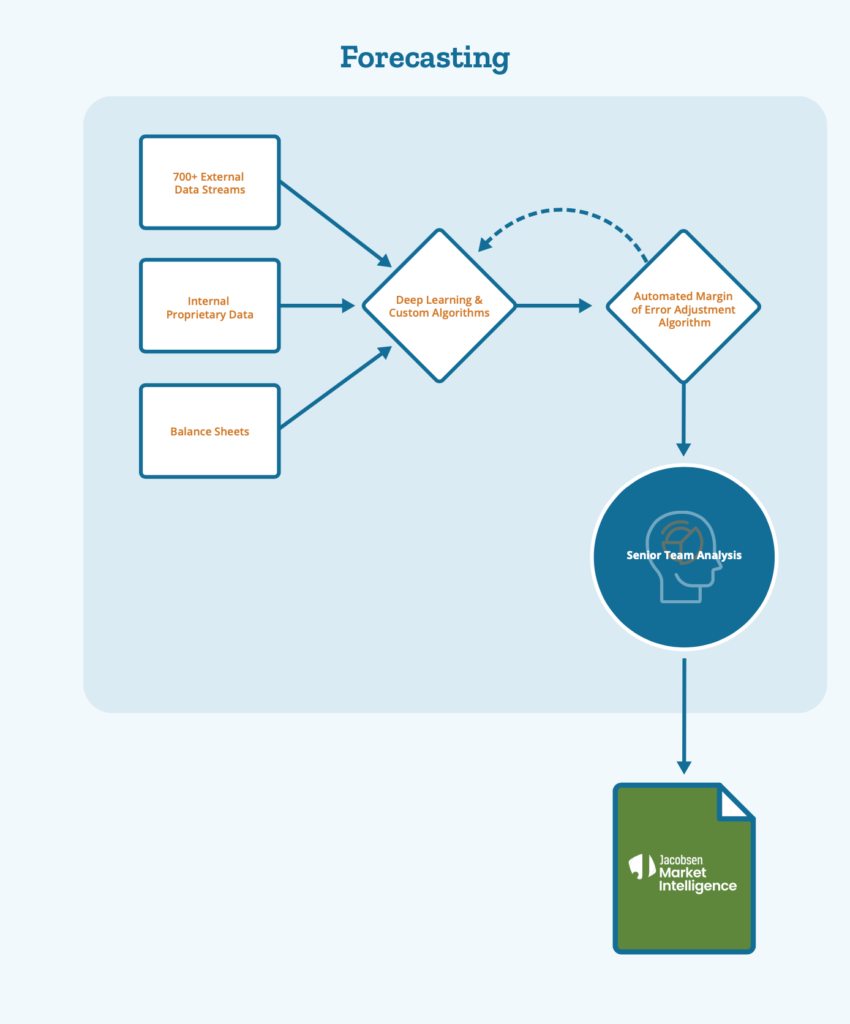

The Jacobsen PRA analysts are hired and trained in accordance with The Jacobsen Hiring and Training guidelines. Junior analysts work in close conjunction with senior analysts in the price discovery process for mentoring and analytical training. Senior analysts have a minimum of ten years of experience trading or reporting on physical commodity markets.

Training of analysts is standardized to ensure consistency across all bulletins and for consistency in the absence of the lead analyst. Assessors are trained in monitoring and reporting any violations to the submitter code of conduct to the Senior Jacobsen staff. Analysts are also encouraged to report any potential misconduct amongst Jacobsen analysts to the Director of the PRA as well as the Jacobsen President.

The Jacobsen holds all of its team members to a high, ethical standard. All employees are required to agree to The Jacobsen Conflict of Interest policy. The policy is reviewed annually, and a copy of the Conflicts of Interest Policy can be requested, in writing, by interested parties.

The Jacobsen stores and maintains relevant data in the price discovery process, i.e. written communication, trade notes from phone calls, chat transcripts and notes from face to face reports in a secure data base for five years. Records generated are specific to individual assessors.

Stakeholder communications are kept for five years.

Exclusion logs, records of infractions of the submitter code of conduct, trade data including volume, counterparties and price, submitter contact form are stored in a secure database for five years.

By applicable law we will provide appropriate documents to regulatory authorities.