By Gary Gagnon

There is usually a lot of speculation in the hide market each year ahead of the spring Asia Pacific Leather Fair. This year the APLF is being held from March 30 through April 1 which coincides with leather business transitioning from the end of its busier period to a slower stretch.

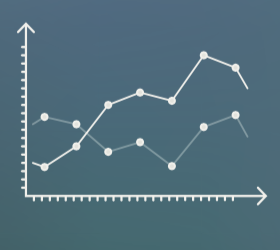

In order to help bring our memories in focus, the chart below shows BBS and NBC prices and the APLF since 2010. The data in general shows that prices following the fair tend to drift lower. It also appears that from the onset of 2012 the market shifted into bull mode with price increases for over two years and then it changed course after the 2014 APLF.After the 2014 fair, prices began to decline for both steers and cows with cow prices continuing to descend and steers leveling off for the summer and then bouncing back in the fall. On October 24 the BBS price peaked at $109.05 then began to drop following the downward trajectory of the cows.

It is worth noting that the suspension from over two years of climbing hide prices to a steady-to-declining period happened when cattle slaughter was in decline. In 2014 the US Federally inspected cattle slaughter was 29.589 million compared to 31.797 million head, down 6.9% from the previous year. For the first seven weeks in 2015, kills are 7% lower than the lows of the same period last year.