06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Last Updated: 10.10.2022

Having a high degree of certainty on where the markets are headed is key to operating a profitable business. At the volume our clientele operate, differences in pennies can translate to millions in revenue. That’s why a trusted forecast is critical in making forward-looking decisions.

Unlike our competitors, The Jacobsen has no positions in the market, therefore our forecasts are an unbiased report of what the data tells us and what our analysts know of the markets.

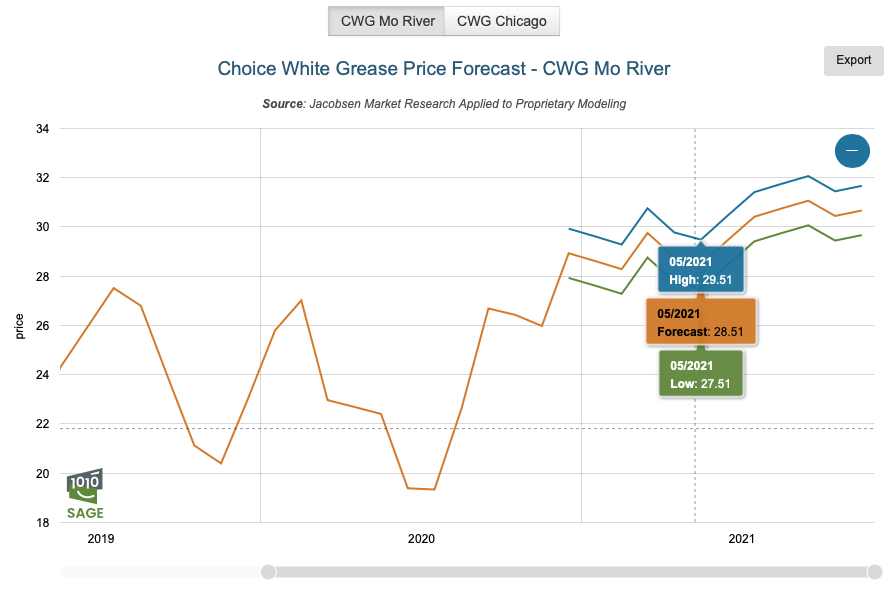

We’ve built our forecasting tool on the back of our proprietary data and applied artificial intelligence to highlight patterns hidden from the human eye, resulting in stunning forecasts that have proven to edge out a few products in the Futures Market.

Most of our forecasts extend out to 12 months on a weekly basis, with the exception of our Hemp Forecast which extends out 4 weeks.

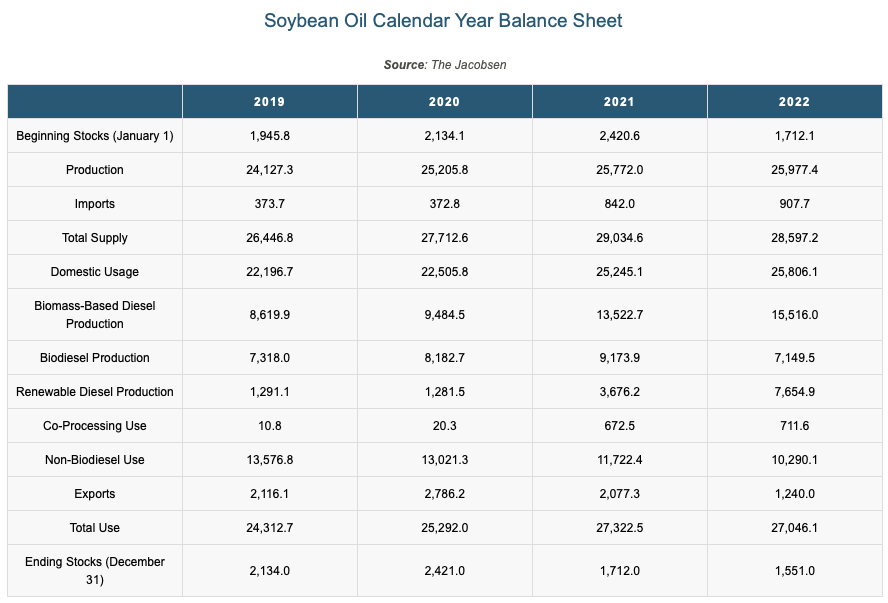

Our balance sheet data is updated regularly so your team can have a clear understanding of the data.

Customers for Fuels, Fats & Oils have access to a weekly, analyst-lead webinar to answer your questions live.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...