06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Joe Gershen – California Biodiesel Industry Commentary April 18, 2016

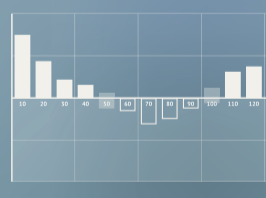

Governor Brown’s 2030 greenhouse gas reduction goals include a 50 percent reduction in petroleum use, preferably by 2030. The California Air Resources Board (ARB) has a sample path towards meeting this goal that includes reducing growth in vehicle-miles travelled (VMT) to four percent; increasing on-road fuel efficiency of cars to 35 mpg and heavy-duty trucks to about seven mpg; and at least doubling use of alternative fuels like biofuels, electricity, hydrogen, and natural gas (see graph).

The devil, of course, is in the details. It appears that the plan is for more than two-thirds of that GHG reduction to come from biofuels, electricity, hydrogen, and natural gas. In 2015 roughly 96 percent came from biofuels, and the rest mostly from fossil natural gas (3.5 percent) and electricity (.5 percent).

But 2030 is a mid-term goal. Let’s focus on the near-term and apply those numbers to the current Low Carbon Fuel Standard (LCFS) requirements. We know that the LCFS requires a 10 percent reduction in GHG emissions in transportation fuels by 2020. We also know that reduction must come primarily from some combination of gasoline substitutes, diesel substitutes, gaseous fuels, vehicle electrification (light-, medium-, heavy-duty EV) and hydrogen fuel cell electric vehicles (FCEV).

In my last article, I proposed an alternative diesel fuel (ADF) target of 20/20 by 2020 – 20 percent biodiesel and 20 percent renewable hydrocarbon diesel (RHD) by 2020. I think a realistic average CI for both biodiesel and RHD would be 30 gCO2e/MJ. I also propose that California can get to E15 (15 percent ethanol in all gasoline) and by 2020 the average ethanol CI could drop to 65 if we’re lucky—and I’m feeling lucky today!

If you run those numbers for ADFs and ethanol, we are very close to achieving the 10 percent carbon reduction. The small balance should be able to be attained with natural gas, zero emission vehicles and other innovative low-carbon fuels and technologies such as renewable crude oil, which are poised for commercialization.

2020 industry projections for natural gas in California are approximately 600 M gpy diesel gallons equivalent (DGE), and some estimates for zero-emission vehicles (ZEVs) puts 440,000 EVs and FCEVs on California roads by 2020. There are currently about 100,000 EVs registered in California, and Governor Brown wants to increase that to 1.5 million by 2025, so the 440,000 estimate by 2020 is not unrealistic. Tesla just pre-sold 325,000 Model 3s, and if half of those go to California we’re more than halfway there!

But by far the largest reduction comes from diesel substitutes and gasoline substitutes. Biodiesel, RHD, and ethanol will provide almost all of the GHG reductions required under the LCFS by 2020. Everything else put together is only a small fraction of 1 percent reduction—and that’s 1 percent of the 10 percent (one-tenth) reduction required by the LCFS.

Faced with these overwhelming odds, it only seems logical that the state would do everything in its power to support a thriving biofuels industry, as I’ve been pointing out in prior articles.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...