04.23.2024

Rising BOHO spread spurs RIN values higher

Despite the move higher, D4 RINs are down 2% in value from the previous week. RIN prices are receiving support from the rising bean oil/heating oil (BOHO) spread, which...

Summary

Leather demand edged lower in August, despite a bounce in Chinese imports which showed its first increase of 2016. Car sales dipped along with Chinese exports, which offset a seasonally adjusted gains in U.S. shoe sales. Global economic data continues to reflect very modest growth, as near zero interest rates have not been enough to stimulate developed economies. The JLDI and Heavy Texas Steer prices moved lower, with steer values revisiting support levels. The trajectory of the JLDI appears to be flattening at a faster pace than hide prices, which reflects the stabilization in Chinese imports.

Economic Data and Monetary Policy

Hide values have slipped, despite an uptick in overall Chinese imports, as global demand moved lower in the latter half of the summer. The Chinese trade number for September were in line with expectations, as hide prices look for a bottom. Chinese authorities reported that August exports fell 2.8% year over year following July’s 4.4% drop. Imports unexpectedly rose 1.5% year over year, reversing a 12.5% in July. August’s increase was the first year over year rise in imports since October 2014.

In the U.S., the data has been mixed. September retail sales increased 0.6% on the headline. The Headline strength was thanks to a vehicle sales bounce and an estimated 6% increase in gasoline prices. Chain store sales were fairly restrained through September, but the major consumer confidence gauges posted gains. Vehicle sales remain strong but their year on year comparisons makes it difficult to post gains. Earnings for the third quarter will shed light on shoe sales and furniture sales.

There are many unknowns that are weighing on the global capital markets which is depressing trade and economic growth. The UK Brexit appears to be heading for a hard exit, which will disruption trade in Europe. U.S. politics are headed for a climax in November, and the Fed is discussing a rate hike in December. Currently the futures markets are forecasting a 65% chance of a rate hike in December, compared to a 15% change in November. This is capping stock prices, which reduces top down spending. The market appears to have priced in a Clinton victory, but if the polls contract, volatility is likely to increase.

As we look forward to the September JLDI, the focus will be on how the Fed maneuvers policy and how the ECB deals with fewer bonds to buy for their quantitative easing program. The catalyst for global growth will be U.S. GDP, where forecasts for the Q3 continue to drop. Higher oil prices could help manufacturing rebound, which could spill over into global GDP, and help increase commodity demand. Chinese imports appear to have bottomed, with September numbers coming in negative, but near expectations. Exports looks like they have stabilized, which should allow Chinese growth to find a foothold between 6.5% – 7.0%.

To produce an index that reflects perceived demand for leather, the JLDI combines changes in the shoes sales, furniture and automobile market given assumption made about the makeup of these markets as leather is concerned. Fluctuation in shoes sales, auto sales, and furniture sales will change the demand dynamic for leather globally.

JLDI Index

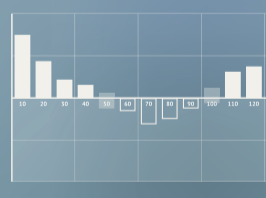

The Jacobsen derived its leather demand index by using an oscillator that captured an index from 1-100. The index is created from year over year changes to each of 4 time series.

The JDLI readings are on the right axis accompanied by prices of Heavy Texas Steer on the left side.