11.21.2025

Sausage casings bulletin, November 21, 2025

...

Per the EIA’s Weekly Petroleum Status Report, average weekly ethanol production fell below a million barrels per day for the first time since October 21st 2016. During the week ending April 7th, production averaged 986 thousand barrels per day, down 33,000 barrels per day from the week prior and 68,000 per day over the past two weeks. Gasoline demand edged 2.9% higher to 279,000 barrels per day. Ethanol stocks pulled back from their all-time high, falling a sharp 802,000 barrels to 22.903 million. Ethanol imports remained at zero for the 33rd consecutive week. The decrease in ethanol production lowered corn demand by up to 489,000 bushels per day. DDGS output fell in sync with ethanol production, declining 3.24% week over week.

The four-month average ethanol production rate is 1,037,789 b/d, down 1,369 barrels per day from last week but remains above last year’s four-month average of 982,000 b/d. At its current pace, the industry is on track to produce 15.9 billion gallons, well beyond the 2017 finalized ethanol RVO of 15 billion gallons. Whether the industry can blend enough to meet the mandate remains the question. Average ethanol production for the latest week, is 48,000 barrels a day more than it was a year ago (986 bpd vs. 938 bpd). Domestic gasoline demand decreased 0.32%/30k bbls per day. Ethanol inventories narrowed 3.38% to 22.903 million barrels. Ethanol production as a percent of gasoline demand decreased to 10.63%. 2017 gasoline demand is, on average, 14.9 million gallons less per day than it was over the same period in 2016.

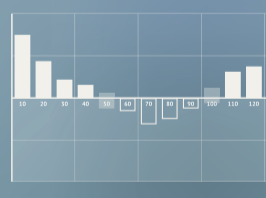

As a co-product of ethanol production, the daily amount of distillers’ corn oil produced is approximately 8.16 million pounds per day, down 273,230 pounds daily from a week ago. The table and chart below show the recent amounts of corn oil produced daily over the past several months. Distillers’ corn oil has seen its demand rise from an average of 9 million pounds used in production per month in 2010, to 109 million pounds per month in 2016.

Due to state mandated low carbon fuel programs like California’s Low Carbon Fuel Standard (LCFS) and Oregon’s (CFS), feedstocks with lower carbon intensity (CI) ratings have been receiving more attention due to the higher credit value they generate. The credit will be larger, the larger the difference between the current baseline CI value and the feedstock CI value.