06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Trading into Indonesia and China was reported steady this week, $540 – 560 CIF. Sources are anticipating a drop off in the Indonesian market when pre-Ramadan shipments conclude, but there are reports of other SEA countries stepping in and building pipelines.

The Australian and New Zealand markets were steady this week with no changes reported with the exception of the Australian domestic price. Local trading was reported higher, $675 – 700, catching up with the export values. Production in the Australian market remains tight as slaughter continues, and will continue, well below the last few year’s numbers.

US export values were steady on feathermeal with action reported at $530 – 550/MT. Sources have reported higher numbers on 60 pro PM, $655 – 660/MT. Offers for the next trading period are higher as demand is reportedly very strong. Pet grade poultry prices are up sharply, $850 – 870/MT into SEA. Trading into China has been done at $950/MT.

Ruminant MBM in the local market trading continues in a wide range, $240 – 265/ST ($265 – 290/MT) for mixed species material and $285/ST ($315/MT) for pure beef. Porcine is sinking under the weight of heavy supplies and may start to weigh on the ruminant market.

The pet grade PBM disappearance into the export market has tightened up local supply and driven domestic prices up sharply. Trading this week was reported $725 – 750/ST or $800 – 825/MT, which would put the next export price north of $900/MT CIF SEA. Since late Q3 of last year sources had predicted big spring numbers on pet grade poultry meal and their prognostications are coming true. Demand from China for pet food production has been the main driver through much of 2017.

US Protein Exports

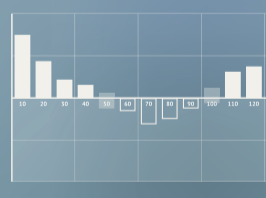

Inedible meat meal exports continue to climb with the Jan and Feb 2017 total surpassing the Jan – April total of 2015. February exports of 43,591 MT were up slightly from Jan of 2017 and up 33.6% compared to February of 2016. The main destinations were Indonesia at 11,970 MT and Mexico at 11,786 MT.

Featheremal exports were off 4.7% compared to February of 2016 and 3.6% compared to January. The main importers were Indonesia at 2,456 MT and China at 1,308 MT.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...