11.21.2025

Sausage casings bulletin, November 21, 2025

...

Organic Corn trading activity remains light as traders await the harvest. Organic farmers generally plant later than conventional farmers in an effort to avoid cross pollination, which leads to a later harvest. Organic corn prices have stabilized near the $7.50-$7.75 range on the farm, for new crop corn that is delivered in November or December. Old crop prices have tumbled, and are trading at a discount to new crop, as those who are long corn, scramble to empty bins ahead of the new crop harvest. The carry for corn is approximately $0.25 per quarter. Non-gmo yellow #2 CIF remained steady at $0.10 premium over conventional for new crop deliver. The most recent yield report from the USDA shows a slight dip in bushels per acre.

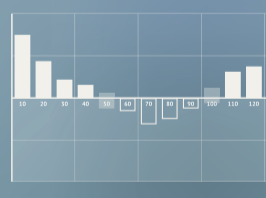

Corn board futures prices remain at the upper end of a 3-month range. According to the most recent commitment of trader’s report released for the date October 11, 2016, managed money significantly reducedshort position in futures and options by 36K contracts which is slightly more than 10%. Managed money that is short futures and options outnumber managed money that is long by approximately 131K contracts.

Mid-west organic soy bean prices are experiencing light activity for November and December delivery. Prices have drifted to the $17.50-17.75 range, with a carry for the first quarter of approximately 25 cents per bushel. Non-GMO soybean CIF are trading $0.75 – $1.00 above cash prices for new crop. Positioning in the conventional market shows that hedge funds reduced both long position and short positions in futures and options. Last week the USDA increased its forecast for soybean yields to another record high of 51.4 bushels per acre, up from 50.6 bushels per acre in September.

Despite the specter of robust bean yields, bean oil futures prices are poised to break out on a weekly basis testing resistance near a downward sloping trend line. A close above the 35.50 level would likely lead to a test of the June 2014 highs near 41.05.

In the News

|

|

|

|