11.21.2025

Sausage casings bulletin, November 21, 2025

...

Trading was quiet to wrap up the week. There was a report of tech tallow offered steady with the current Chicago pricing, but as of press time there was no action reported. Other market indications from buyers and sellers were echoes of the market tone that have been present throughout the week, lower bids for CWG and YG out of bio and steady sales into feed.

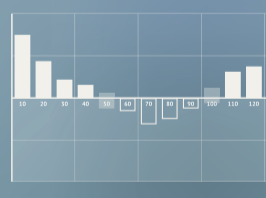

Tallow prices are attempting to find a toehold, following the recent decline from the highs above 37. With bean oil and other vegetable oils rising in the wake of the hot dry conditions in the U.S., tallow prices could stabilize. Prices appear to be forming a bull flag pattern which is a continuation pattern where there is a pause that refreshes higher. Support is seen near the 20-week moving average at 35. Resistance is seen near the Bollinger band high which is 2-standard deviations above the 20-week moving average at 38. The Bollinger bands are near the wideest levels seen in 2017, and are now contracting reflecting decelerating historical volatility.

Momentum has turned positive as the MACD (moving average convergence divergence) index recently generated a crossover buy signal. This occurs when the spread (the 12-week moving average minus the 26-week moving average) crosses above the 9-week moving average of the spread. The MACD histogram is printing in the black with an upward sloping trajectory which points to higher prices.

The daily MACD is relaying a different story. Here the MACD recently generated a sell signal. This occurs as the spread (the 12-day moving average minus the 26-day moving average) crosses below the 9-day moving average of the spread. The MACD histogram is printing in the red with a downward sloping trajectory which points to lower prices for tallow.

The relative strength index (RSI) which is a momentum oscillator that measures accelerating and decelerating momentum, has stabilized near the 60 level, and has declined from oversold territory. The current reading is on the upper end of the neutral range, but reflects consolidation.

For any comments or questions in regards to Tallow Prices Find a Toe Hold, and Stabilize After Slide, please contact David Becker at [email protected]

Please contact Ryan Standard at 563.223.9021 or [email protected] with any questions, comments or trading.

Broiler-fryer slaughter under federal inspection for 14-Jul-17 and 15-Jul-17 is estimated to be 33,622,000 head down 7.05 percent from a week ago and down 1.3 percent from a year ago. (Last week 36,173,000, last year 34,072,000)

Weekly broiler-fryer slaughter under federal inspection for the week ending 15-Jul-17 is estimated to be 165,955,000 head up 16.98 percent from a week ago, and up 1.84 percent from a year ago.(Last week 141,867,000, last year 162,953,000