11.21.2025

Sausage casings bulletin, November 21, 2025

...

The Energy Information Administration’s (EIA) January Biodiesel Production Report showed 144 million gallons of biodiesel produced using 1.114 billion pounds of feedstock. Production fell 13 percent from December but was 18 percent more than January of 2018. Feedstock consumption was down 14 percent month over month but up 16 percent year over year. The ratio of feedstock used per gallon of biodiesel produced increased from 7.64 pounds per gallon to 7.74.

According to the EIA, production came from 100 biodiesel plants with a capacity to generate 2.54 billion gallons a year. This indicates that production, as a percent of capacity, was at 68 percent, down 14 points from last month. Monthly domestic production capacity, per the EIA is 211.7 million gallons, up from 204.9 million in December.

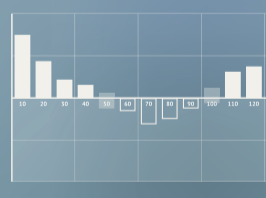

The biodiesel industry’s most widely used feedstock is soybean oil. Soybean oil use accounted for 56 percent of the feedstock total. The other top feedstock selections during January were distillers’ corn oil (DCO), yellow grease, canola oil, white grease, and tallow.

Soybean oil continues to be the industry’s favorite feedstock but use dropped by 145 million pounds to 623 million during January. Distillers’ corn oil was the second most widely used feedstock. DCO use decreased by 20 percent and accounted for 13 percent of the feedstock total. Yellow grease consumption fell 13.6 percent and was 11 percent of the feedstock mix. Canola’s inclusion rate was up 15 and was estimated to be eight percent of the feedstock total. White grease consumption climbed 40 percent to 63 million pounds and was 5.7 percent of the total.

California’s low carbon fuel standard (LCFS) places a premium on the use of lower CI inputs and with the LCFS credit trading near historic highs there is a strong incentive for low CI feedstock use to continue to rise. Biodiesel production from lower carbon intensive (CI) feedstocks was 391 million pounds, representing 35 percent of the feedstock total, while production from higher CI feedstocks was 723 million pounds, or 65 percent of the total. Low CI feedstock use climbed from 33 percent of the monthly feedstock total in December to 35 percent in January.

With the California LCFS credit at $191, production of biodiesel from UCO/yellow grease can be worth up to $1.77 to $182 per gallon. Biodiesel produced from DCO and tallow would generate credits of over $1.42 per gallon.

Vegetable oils use in the feedstock mix decreased from 80.8 percent in December to 77.5 percent in January. Total vegetable oil use declined from 1.037 billion pounds to 863 million as production slowed. The monthly consumption of animal fats, oil, and grease (FOG) totaled 251 million pounds, up two percent month over month. FOGs inclusion rate for the month increased from 19.2 percent to 22.5 percent.

Last month Shell announced that they planned to reduce their carbon emissions from their oil and gas facilities by two to three percent during the 2016-2021 time frame. This was the first time that Shell issued carbon footprint targets. In an effort to ensure compliance, Shell linked the targets to executive pay.

BP and Total have already set short-term targets on carbon dioxide emissions reductions. Their targets are limited to their own operations. Shell takes things a step further. Shell’s two to three percent reduction targets include not only cutting greenhouse gas emissions from their oil and gas extraction and refining, but also from fuels and other products sold to their customers – known as Scope 3 emissions.

Today, a Reuters article announced that Shell has become the first major oil and gas company to walk away from a leading US refining lobby due to differing beliefs on climate change policies. The company has been listening to its investors and determined that they have a material misalignment over climate policy with the American Fuel & Petrochemical Manufacturers (AFPM). To read the full article click on the Reuters link below.

Apr 02 (Reuters) Citing climate differences, Shell walks away from U.S. refining lobby – Royal Dutch Shell Plc on Tuesday became the first major oil and gas company to announce plans to leave a leading U.S. refining lobby due to disagreement on climate policies. In its first review of its association with 19 key industry groups, the company said it had found “material misalignment” over climate policy with the American Fuel & Petrochemical Manufacturers (AFPM) and would quit the body in 2020. READ MORE

Mar 20 (Governors’ Biofuels Coalition) Cruz Says EPA’s Wheeler Promised to Continue Granting Small Refinery Waivers – Senator Ted Cruz (R-Texas) says he won “explicit promises” from EPA Administrator Andrew Wheeler to keep granting small refineries waivers from U.S. biofuel mandates, without retroactively reallocating those quotas to non-exempted facilities. Cruz says he secured those commitments after joining with other Republican senators to slow down Wheeler’s nomination to lead the EPA. READ MORE

Mar 08 (Public News Service) Report Calls Biofuels Standard an Environmental Disaster – The Renewable Fuel Standard or RFS was intended to reduce reliance on oil imports and cut air pollution. It requires that all gasoline for transportation sold in the United States contain at least 10 percent ethanol. But the report from the National Wildlife Federation says that has led to the conversion of 1.6 million acres of grassland, shrubland, wetlands and forests to agricultural production, including land here in New York. READ MORE

I always look forward to hearing from our customers. Please feel free to contact me with any questions, comments, or suggestions you may have. If you buy, sell, or trade any of our products, I would like to hear from you. Bob Lane at [email protected] 847-549-3640.