11.21.2025

Sausage casings bulletin, November 21, 2025

...

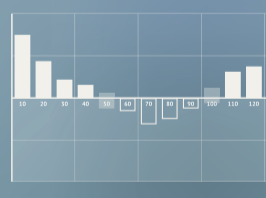

The average credit price declined $0.98 to $193.55. Third quarter transaction volume continues to be strong and well supported by high credit prices. Weekly credit volume decreased in the latest weekly report, showing a total of 210,030 credits trading during the week ending Aug 11. This is down 20 percent from last week but 166 percent over the same weekly period last year. The 2019 average weekly credit volume increased from 207,151 to 207,241. The 2019 weekly transaction average is 23 per week. Third quarter credit volume is 54 percent over second quarter volume and 50 percent above the same quarterly total last year.

Credit volume was heaviest on Monday with 29 percent of the transactions taking place. The highest average daily price was $198, which occurred on Wednesday. The price range credits traded in expanded from to $188.50 – $198 last week to $177 – $199 in this week’s report. The weighted-average credit price slipped to 193.55 down from $194.53. The value of the weeks credit transactions totaled $40.65 million. At the top of the range 26,000 credits traded at $199 and 1,776 traded at the bottom of the range at $177. Ninety one percent of the credits traded at a price between $190 and $199 and 4 percent traded below $180.

The Jacobsen expects credit volume to exceed last year’s pace. An additional 284 million gallons of biodiesel and renewable diesel are forecast to be consumed within the California market during 2019. There were 11.18 million LCFS program credits generated during 2018 and there are 13.7 million forecast for 2019.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded four transfer of 3,190 credits. CARB will exclude transfers that trade at, or near, zero in price.

A very turbulent stock market and shifting consumer sentiment on recession fears has whipsawed oil prices over the past six trading sessions. Oil prices have spanned a low of $50.52 per barrel to a high of $57.47 per barrel. Heating oil values have been pulled along for the ride. Today heating oil prices fell 3.4 cents to roughly $1.84 per gallon. Soybean prices for September delivery were unchanged. Lower heating oil values propped the BOHO spread up three cents to 30 cents per gallon.

While the threat, and then release of the EPA’s small refinery exemptions (SREs) have led to a structural disconnect between the BOHO and RIN prices over the past several weeks, RINs did show some sign of performance as the 2019 biodiesel RIN edged higher today. This could either be a coincidence or it might be that RIN values are starting to respond to the BOHO.

California’s LCFS credit saw offers edge higher. Prices have been consistently reported in the $195 to $197 range. Lower trades have occurred, but volume and price have seemed to have found a new plateau for the moment. Interestingly, data from the first quarter release on LCFS performance shows that California accounted for 98.98 percent of all the renewable diesel consumed in the United states but only 10 percent of the biodiesel. This is a big step forward in renewable diesel consumption but given the great margins for the product it is easy to see why producers would be shifting as much of their product into CA as possible. REG’s recent quarterly report stated that out of the 505-million-gallon name plate capacity that more than 50 percent of their 2018 earnings came from their 75 million gallon a year renewable diesel plant. During 2018, California accounted for 80.3 percent of renewable diesel consumption and 9.1 percent of biodiesel consumption.

Aug 13 (Market Watch) Buttigieg pledges to stop ‘small refinery’ exemptions hurting biofuel farmers – Presidential hopeful and South Bend, Ind., mayor Pete Buttigieg climbed on the Iowa State Fair soapbox Tuesday. Ahead of the key stopover in the early caucus state for the 2020 race, the candidate released his ideas for helping rural Americans. The proposal focused on internet access and supporting satellite college campuses, and it had a climate component. Buttigieg addressed ethanol and other biofuels: “Pete will stop the abuse of ‘small refinery’ exemptions established by the current administration, which allows fossil fuel giants to skirt their obligations to blend biofuels,” the plan reads. READ MORE

Aug 06 (Biodiesel Magazine) Brazil moves big step closer to B15 with issuance of final report – Brazil’s Ministry of Mines and Energy published Aug. 2 its final report on B15, giving a green light for the National Agency for Petroleum, Natural Gas and Biofuels (ANP) to set the national mandate at the 15 percent level. READ MORE

July 29 (Reuters) U.S. EPA set to rule on refinery biofuel waivers requests in coming weeks – The Environmental Protection Agency hopes to rule in the next few weeks on 2018 petitions to obtain small refinery waivers from the nation’s biofuel laws, administrator Andrew Wheeler said on Monday. “We’re going through them,” Wheeler told reporters on the sidelines of his visit to Monroe Energy’s oil refinery in Trainer. “We hope to be processing them and making decisions in the next few weeks and month at the most,” he said. READ MORE

I always look forward to hearing from our customers. Please feel free to contact me with any questions, comments, or suggestions you may have. If you buy, sell, or trade any of our products, I would like to hear from you. Bob Lane at [email protected] 847-549-3640.