11.21.2025

Sausage casings bulletin, November 21, 2025

...

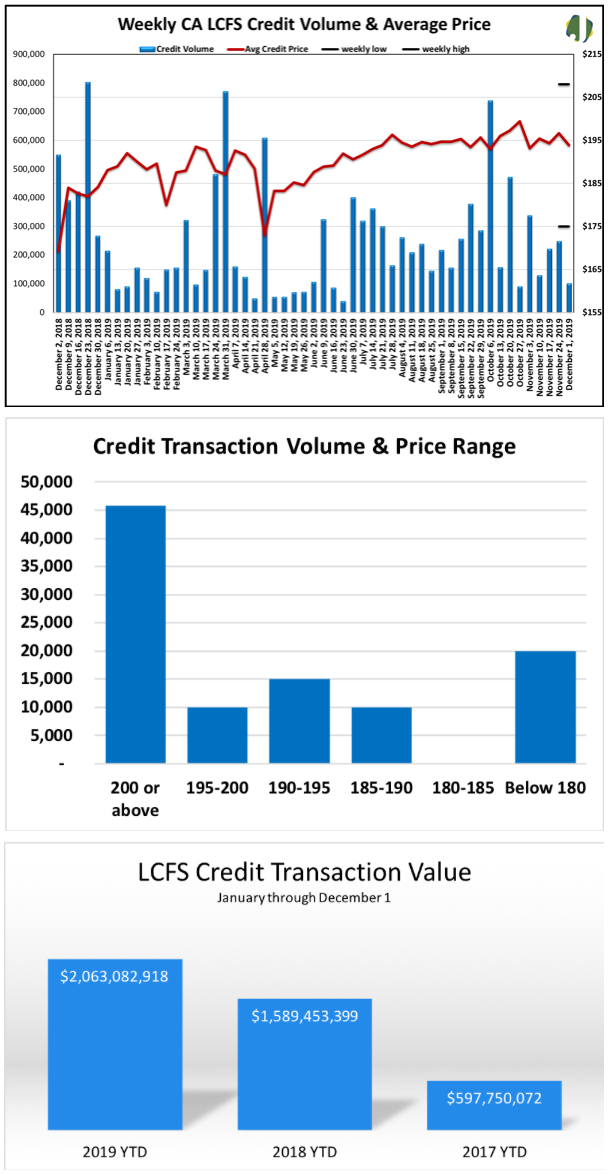

Credit prices did not set another record high during the Holiday shortened week but remained near peak levels. The latest trading data released by the California Air Resources Board (CARB) shows credit volume dropped and prices edged lower during the last week of November. Credit volume narrowed 59 percent from the week prior and was 82 percent below volume reported during the same weekly period a year ago. The LCFS weighted average credit price declined $2.79 to $193.89. Weekly Credit volume was 100,839 on 10 transactions. Average 2019 weekly credit volume shifted from 227,927 to 225,279. Fourth quarter volume is 12 percent over third quarter volume and five percent above Q4 of 2018.

Trading volume was heaviest on Monday with 49 percent of the transacted volume taking place. The highest average daily price was $200 and occurred on Tuesday. The price range credits traded in narrowed from to $140 – $210 last week to $175 – $208 in this week’s report. The value of the week’s credit transactions totaled $19.6 million down from $48.9 million last week. At the top of this week’s price range, 14,000 credits traded for $208 and 20,000 traded for $175 at the bottom of the range. Forty-five percent of the transactions occurred at a price of $200 or higher, 25 percent of the trades happened between $190 and $199.99, and 30 percent were below $190. The value of this year’s credit transactions is 2.06 billion, which is 30 percent over last year’s total of 1.5 billion through the same weekly period. California’s credit clearance market (CCM) caps credits values at $200 based on 2016 dollars. This has a current value of $213.07 today. While the CCM is not currently in effect and there is no current cap on where day to day LCFS prices can trade, look to this price to act as resistance for credit values.

The Jacobsen expects credit volume to exceed last year’s pace. An additional 1.755 million credits from biodiesel and renewable diesel are forecast to be generated within the California market during 2019. There were 11.18 million LCFS program credits generated during 2018 and 13.7 million forecast for 2019. Renewable diesel and biodiesel credit generation is expected to reach 6.62 million, or 48 percent of all program credits. There have been 10.8 million credits transacted so far this year.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded 1 transfers of 3,112 credits. CARB will exclude transfers that trade at, or near, zero in price.