11.21.2025

Sausage casings bulletin, November 21, 2025

...

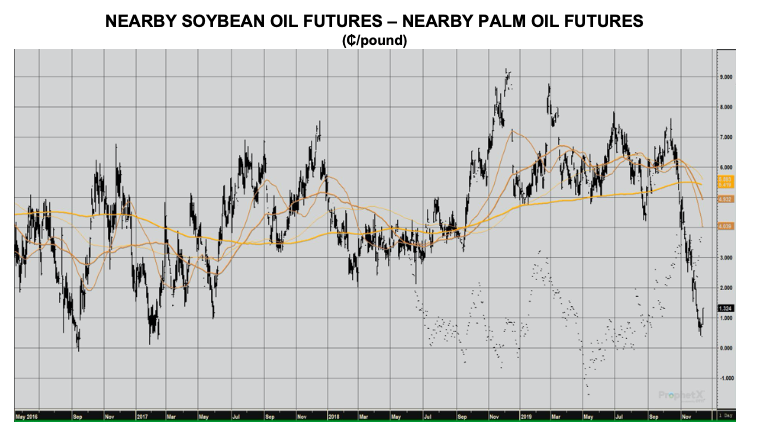

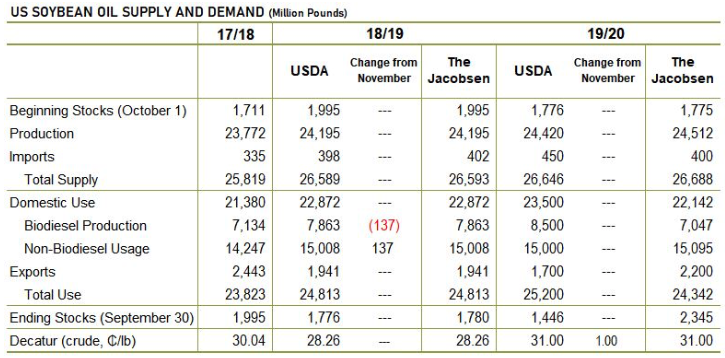

The United States Department of Agriculture’s (USDA’s) latest World Agricultural Supply and Demand Estimates (WASDE) report did not contain any substantial revisions to its U.S. soybean oil balance sheet. The only change from the November report was the adoption of the soybean oil usage in biomass-based diesel data from the Energy Information Administration (EIA), which resulted in a shift of 137 million pounds of domestic usage from the non-biodiesel category to biodiesel. In the report, the USDA also raised its forecast for the 2019/20 average price of crude soybean oil in Decatur to 31 cents per pound, which is in line with The Jacobsen’s projection.

With the report out of the way, traders shifted their focus back to biofuel policy. Two substantial developments in biofuel policy could have a significant impact on the outlook for soybean oil futures prices. The first and arguably more important is the reinstatement of the Biodiesel Blenders’ Tax Credit (BTC). Soybean oil futures shot up by roughly 1 1/4 cents during U.S. trading hours and early in the overnight session due, in part, to developments, which suggested the probability of Congress restoring the BTC was at the highest level of the past year.

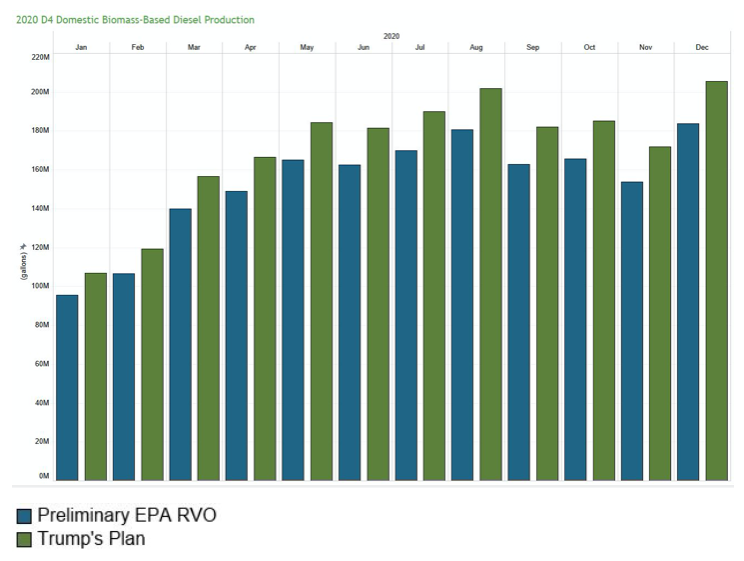

The other biofuel policy development, which could have a substantial impact on the outlook for soybean oil futures prices, is the announcement of finalized renewable volume obligations (RVOs) by the Environmental Protection Agency (EPA). Traders and analysts will focus on how the EPA will offset waivers under the Small Refinery Exemptions (SRE) program, which is basically the implementation of a proposal from President Trump to increase domestic biofuel consumption. There has been substantial speculation and uncertainty about the ultimate impact of the plan on biofuel production and ultimately the demand for soybean oil from biomass-based diesel producers.

Due to the unprecedented level of uncertainty surrounding biofuel policy, The Jacobsen has been conservative in its forecast of demand for soybean oil from biomass-based diesel producers during 2019/20. As a result, The Jacobsen expects to revise its current prediction of just over seven billion gallons substantially higher following the resolution of both situations. The Jacobsen’s prediction is almost 1.5 billion pounds below USDA’s December projection, which The Jacobsen assumes could decline even if the resolution of both situations suggests a substantial increase in demand from The Jacobsen’s forecast.

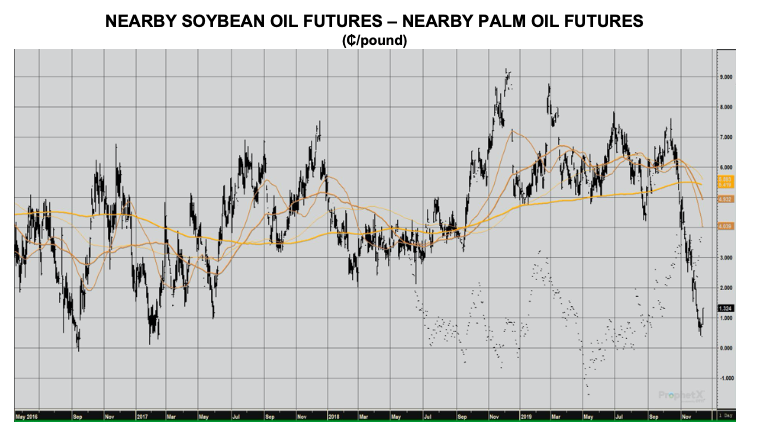

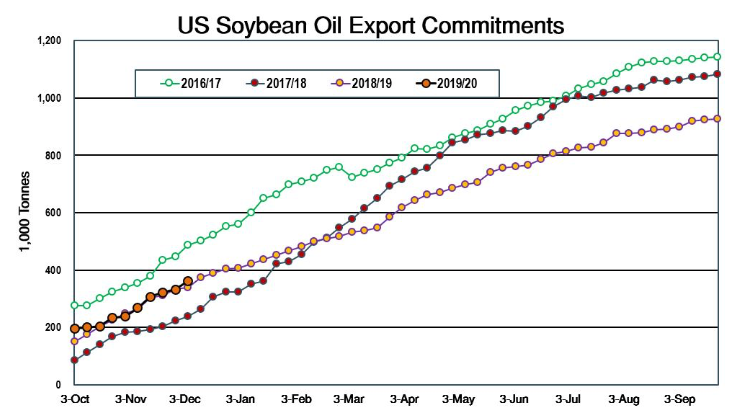

The Jacobsen assumes USDA will offset any decline in its forecast of biodiesel demand with an increase in its projection of soybean oil exports. While it is early in the marketing year, soybean oil commitments are running slightly ahead of 2018/19, when shipments totaled almost 1.95 billion pounds. Shortages in competing oils and a multi-year low in the spread between soybean oil and palm oil suggest U.S. soybean oil exports are likely to meet or exceed the pace set last year. USDA’s December forecast of 1.7 billion pounds is 500 million pounds below The Jacobsen’s prediction of 2.2 billion. However, The Jacobsen is also likely to at least partially offset the increase in its projection of biodiesel demand with a decrease in its export forecast.

The result of the changes The Jacobsen expects to make to its balance sheets in the coming month will be a substantial reduction in its 2019/20 ending stocks forecast. The Jacobsen’s current projection of 2.35 billion pounds is 899 million pounds above USDA’s December prediction. The Jacobsen assumes the changes it makes will reduce that gap substantially and expects its 2019/20 soybean oil ending stocks forecast will decline to around 1.5 billion pounds.

The Jacobsen expects the significant decline in U.S. soybean oil ending stocks and tight world vegetable oil stocks will support soybean oil futures in early 2020. The nearby continuous contract has already rallied almost six cents from the low of 26.11 cents set in early May. However, the uncertainty about biofuel policy has weighed on prices, which can be seen in the price of soybean oil relative to other vegetable oils. The spread to palm oil suggests that soybean oil is four to five cents per pound below its fair value. The Jacobsen believes that if both biofuel policy decisions support soybean oil demand, soybean oil futures could close that gap before the end of the first quarter of 2020. If the final RVOs are not as large as many expect, the rally is likely to be muted, but if Congress does not reinstate the BTC before the end of 2019, soybean oil futures could drop sharply in the short term. Whether prices would recover would depend on the outlook for the restoration of the credit early in 2020.