11.21.2025

Sausage casings bulletin, November 21, 2025

...

While organic corn prices remain subdued, organic soybean prices along with organic soybean meal prices are generating interest. Organic soybean oil prices surged in the Q3 and Q4 of 2019 and continue to hover near the 75 cents per pound level. The fundamental shift away from organic soybean imports to organic soybean meal imports have created a new structural dynamic that will likely keep organic soybean oil prices elevated.

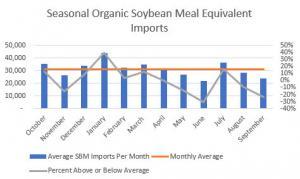

The Q1 of 2020 will be an important quarter for organic soybean meal equivalent imports. The Jacobsen uses a crush equation of 73% to estimate the organic soybean meal that can be crushed in the US with organic soybeans that are imported. This is added to organic soybean meal that is imported into the US to create an organic soybean meal equivalent that is imported into the United States.

Historically, the Q1 has experienced the largest volume of soybean meal equivalent imported into the United States. This makes sense as it is the earliest period following the harvest from the largest importer into the US which is India. The average sum of organic soybean meal equivalent that is imported into the US in the Q1 is 74K metric tons. Historically, over the past 3-seasons, January has experienced the largest volume of organic soybean meal equivalent imports into the US at 40% above the historical average of the 12-months in the year.

The seasonal statistics make the beginning of the q1 a very important period for market participants. There is word from merchandisers that a larger than normal volume of 46 protein soybean meal is making its way to the US just at a time when prices are beginning to move higher. The organic soybean harvest in the US was less than ideal with wet, dirty beans showing up at feed mills and merchandiser storage facilities. Prices are currently near 715 per metric ton FOB India. The Jacobsen has heard prices up to 800 per metric ton delivered into south-central PA.