11.21.2025

Sausage casings bulletin, November 21, 2025

...

When analyzing the ETF and ETN realm. ETFs, or exchange-traded funds, and ETNs, or exchange-traded notes, are very similar to stocks. They hold a variety of assets with the intention of tracking a particular index. These are great tools to use for valuations, projections, and viewing the health of a sector or subsector. An ETF and an ETN that exist within the agriculture and livestock spaces are the iShares MSCI Global Agriculture Producers ETF (NYSEArca: VEGI) and iPath Series B Bloomberg Livestock Subindex Total Return ETN (NYSEArca: COW).

VEGI attempts to portray the global agriculture markets, while being sensitive to commodity prices. VEGI’s average Market Cap is $17.86B and has 144 holdings. The portfolio has stable and above average P/E Ratio of 26.03 a P/B Ratio of 1.71. Diving deeper in the sector, COW follows lean hog and live cattle futures. COW’s assets under management is $34.81M and is exposed in futures contracts. The ETN tracks is the Bloomberg Livestock Subindex.

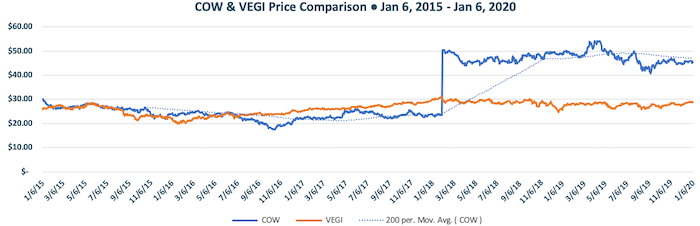

The chart below represents the prices of the fund and note over the past five years. In addition to the prices, the trendline of the 200 day Moving Average for COW depicts a smoother representation of the price. From 2015 to 2018, the two ran closely to each other. Once the Tax Cuts and Jobs Act was signed in February 2018, COW saw a bump in price thanks to the lowered tax burdens on the agriculture community. Ever since, the ETN has been stable and performing well.

VEGI and COW give different perspectives on the agriculture and livestock markets than just directly viewing the commodities. The indices are proving health and stability, which may be a good sign for the direction and wellbeing of the hides market. However, these prices do not positively correlate to hides prices. When compared to the Jacobsen’s prices for Heavy Texas Steers, VEGI and COW inversely correlate at -0.46 and -0.76.