11.21.2025

Sausage casings bulletin, November 21, 2025

...

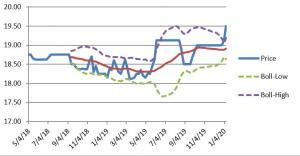

Organic soybean prices have broken out on a weekly basis, hitting the highest levels seen since April of 2016. Target resistance is seen near the $22 per bushel level. Support is seen near former resistance near the Bollinger band high (2-standard deviations above the 20-week moving average), near $19 per bushel and then the 20-week moving average at $18.80 per bushel. Historical volatility is beginning to accelerate higher. The Bollinger bands are expanding away from one another. Bollinger bands are calculated by looking at the variance in the returns of the price. As they expand, the variance between the lower end and the higher end increases which reflects accelerating historical volatility. Robust volatility on a breakout is a confirmation of the breakout.

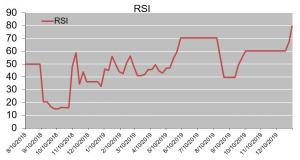

Momentum is accelerating higher. The weekly RSI (relative strength index), is a momentum oscillator that measures the difference in price over the past 14-weeks. The RSI has accelerated to new highs confirming accelerating positive momentum in tandem with a breakout. The RSI hit the highest levels in 2-years. The only caveat is that prices are now overbought. The RSI index produces reading between 1 and 100. Levels over 70 are considered overbought and levels below 30 are considered oversold. Despite the rally in organic soybean prices, they have failed to buoy organic corn prices and organic wheat prices.