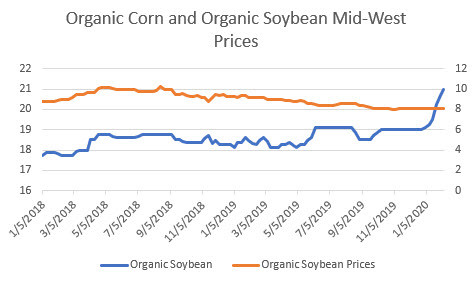

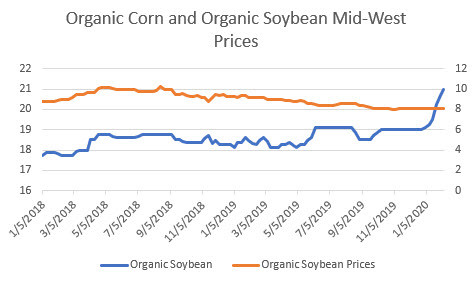

Organic corn and organic soybean prices are diverging. While demand, which is driven by animal feed needs, is expected to remain stable during the balance of 2020, the supply of organic soybeans is expected to decline due to slowing imports. Organic corn imports are expected to rise during the current harvest season which should continue to weigh on organic corn prices.

During the 2018/2019 harvest season, organic soybean imports were replaced with organic soybean meal imports, reducing the volume of organic soybeans that made their way to US shores which generated tailwinds for organic soybeans and organic soybean oil prices.

For the balance of 2020, The Jacobsen sees this divergence between organic soybean prices and organic corn prices continuing. Organic corn prices in the mid-west picked up at the farm are hovering near the $8.00-$8.25. Organic soybean prices have surged higher, driven by solid demand and declining supply, and are quoted near $21 per bushel.

The Need for Imports

US demand is reliant on organic grain imports into the United States. Approximately 20% of the organic corn that is used for feed in the US is imported. Most of the organic whole corn that is imported into the US comes from Argentina, while the cracked corn that is imported into the US generally originates in Turkey.

Approximately 70% of the organic soybeans and organic soybean meal that is consumed in the US are imported. Most of the imports that make their way into the US are exported from India.

Organic Corn Price Forecast

US domestic organic corn production was nearly unchanged year over year for the 2019/2020 season at 62-million bushels. The Jacobsen expects that imports of organic whole corn and organic cracked corn will rise during the balance of the 2019/2020 season by approximately 8% climbing to 16.2 million bushels.

With demand expected to remain unchanged year over year, the stock to use ratio is expected to climb generating headwinds for organic corn prices. For the 2019/2020 season, The Jacobsen sees organic corn prices that are picked up at the farm in the mid-west averaging $8.3 down from $8.60 seen during the 2018/2019 harvest season.

Organic Soybean Price Forecast

A combination of factors has led to a rally in organic soybeans up to $21 per bushel mid-west picked up at the farm. The Jacobsen sees this trend continuing for the balance of 2020. During the 2018/2019 season imports of organic soybeans dropped by nearly 100,000 metric tons and were replaced by a similar volume of organic soybean meal.

The decline in organic soybean imports into the US reduces the number of organic soybeans available to crush. This led to a contraction in the available organic soybean oil by approximately 11,000 metric tons. Organic soybean oil prices surged higher during the fall of 2019, rising by from approximately 35 cents per pound to 75 cents per pound.

Organic soybean prices have hit multi-year highs and are likely to continue to remain buoyed as imports of organic soybeans to the US continue to slow. The Jacobsen expects that organic soybean imports from India, the largest exporter of organic soybeans to the US, will decline by 40-50% during the 2019/2020 due to a poor harvest. Most of the supply will be offset by a slight increase in organic soybean meal imports.

The Jacobsen expects the stock to use ratio of organic soybean meal to decline substantially during the 2019/2020 season. In addition, the US harvest saw a decline in organic soybean production by approximately 22%. This puts the average price of organic soybeans for the harvest season up to $21 per bushel, with prices likely topping out for organic feed grade soybeans at $23 per bushel.