11.21.2025

Sausage casings bulletin, November 21, 2025

...

With huge losses on heating oil and crude prices today, most in the market were content to sit out buying and selling today. The market tomorrow should provide additional insight into market direction, but anything short of a full recovery is apt to correct fat prices lower.

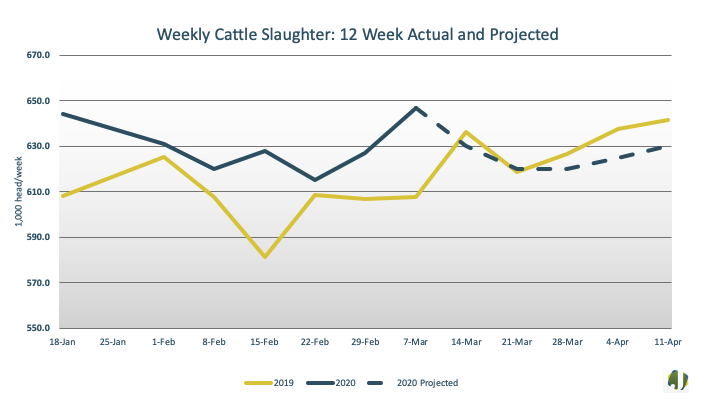

Cattle slaughter finished last week at a robust 647,000 head, up 6.5 percent from a year ago and 3 percent relative to the year prior. Slaughter is forecast to move slightly lower over the next six weeks. This week, slaughter is projected out at 630,000 head, down 2.6 percent from last week. Over the next six weeks, slaughter is forecast at an average of 625,000 head, down an average of ½ of a percent from the prior six weeks. While numbers are expected to be down, production is still expected be strong with the cattle numbers well over 600,000 head. Given the current economic climate, the strong production adds further risk of lower prices to the market.

Figure 1.