11.21.2025

Sausage casings bulletin, November 21, 2025

...

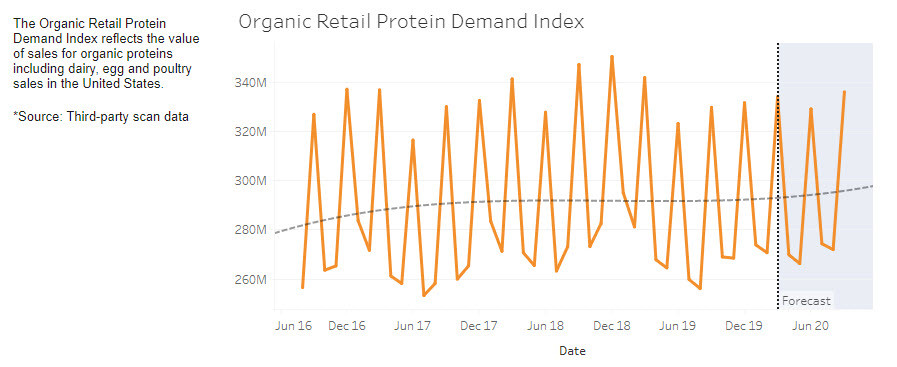

Organic retail demand is predicted to rise during the balance of the 2019/2020 season according to the Jacobsen insight. A strong tailwind lead by increased demand for food purchased at supermarkets and big-box stores will buoy demand. The rapid shift in US short term interest rates, in conjunction with the fiscal policy, will help further catapult purchases of organic goods when pent up demand is unleashed and the coronavirus fades. This should help buoy organic grain prices including organic corn prices and organic soybean prices.

Social distancing is poised to buoy demand for retail organic food. Supermarkets in impacted coronavirus areas are having a tough time holding on to consumer staples like water, and meat, that can be frozen. While there might be a pause in demand as this scenario fades, strong monetary and fiscal policy will buoy demand. The last time US interest rates were dropped to zero, they stayed there for 7-years.

The White House announced several fiscal stimulus policies as well as formulated a policy on social distancing. They are requesting social distancing for the next 15-days. This will likely buoy demand for organic proteins including eggs, dairy, and chicken. While there will likely be a dip initially when things “go back to normal”, the stimulus in the economy should allow for an upgrade cycle for those who might consider organic as a choice over conventional. The fiscal policy in conjunction with the powerful monetary policy should help accelerate growth in the Q4 of 2020 into the Q1 of 2021.