04.24.2024

Biodiesel output strong in Q2; producers start locking in Q3-Q4 sales

A second producer echoed this sentiment and said they have had to work a bit harder to secure feedstock to line it up with sales at the right time.

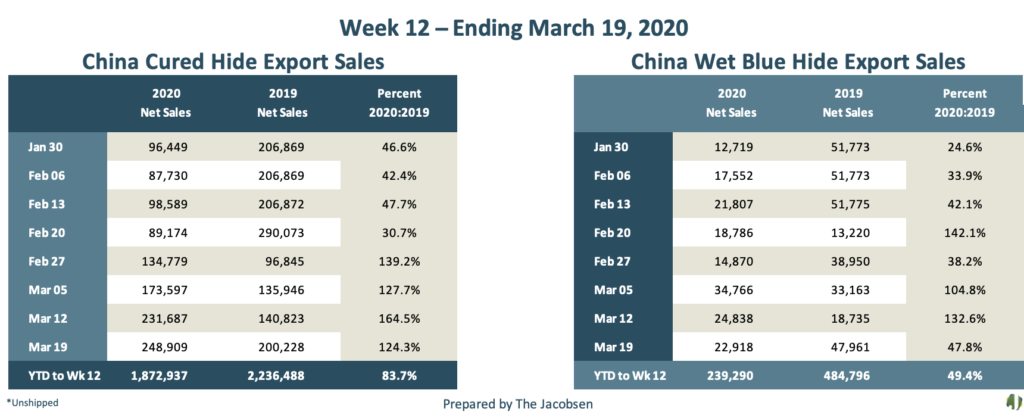

The effect of COVID-19 on the hide market is starting to be shown through analytics. Now that there are a few weeks of USDA reports on Chinese exports, we can look at the impact.

From January 30 to March 19, cured hide sales have seen a significant jump. On January 30, around the peak of the virus, China exported 96,449 cured hides which was 53.4% down from the previous year. Since then, week-after-week has shown increasing interest. As of March 19, cured hides from China have risen 158.1%. This represents a 24.3% gain from the same week of last year.

As for wet blue sales, January 30 to March 19 has shown an increase, but with much less of an interest. On January 30, China exported 12,719 wet blue hides which was 75.4% down from the previous year. Since then, week-after-week has shown fluctuating, but growing interest. As of March 19, wet blue hides from China have risen 80.2%. This represents a 52.2% loss from the same week of last year.

Beef demand is at record levels, but cattle hides are piling up. According to HedgersEdge.com, beef processors made a profit margin of $611.10 per head on Tuesday, March 24, 2020. This is up from the previous week’s $317.10. The Jacobsen’s resources have described the influx of hides as overwhelming and concerning due to the minimal demand for leather at this time.

The automotive industry is extremely quiet due to the consumer’s nonexistent interest and the shutdown of factories, such as GM and Ford. These automakers are focusing their energies on producing ventilators.

The footwear industry has also been struggling. Stores like Puma and Nike have had to close stores, as result of the government’s social distancing and essential business requirements. With the unavoidable, negative effects on revenue and earnings, these companies will have to find other ways to find profits.

However, more Chinese workers are returning to business. According to the Zhaopin research study, about 80% of the automobile industry, about 70% of the agriculture industry, and 65% of the retail/wholesale industry has returned to work as of March 5th.

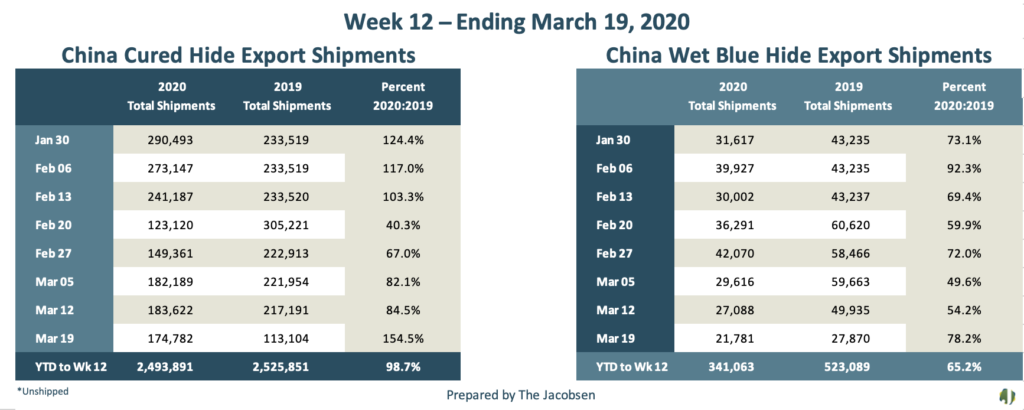

Additionally, shipments out of China still pose an issue. The Jacobsen’s contacts report that the ports are extremely backed-up, causing a multitude of delays and cancellations. The Chinese are low on equipment to ship and there are few places that they can ship to as of now.

On January 30, cured hide shipments out of China to the US were reported at 290,493. This is 24.4% more than the same week of 2019. As of March 19, cured hides from China have fallen 39.8%, which is currently at a 1.3% decline in comparison to the 2019 YTD up to Week 12.

As for wet blue shipments, January 30 to March 19 has reported a decrease at a similar rate to the previous year, but at a smaller volume. On January 30, wet blue shipments out of China to the US were reported at 31,617. This is 26.9% less than the same week of 2019. As of March 19, wet blues from China have fallen 31.1%, which is currently at a 34.8% decline in comparison to the 2019 YTD up to Week 12.

With less of a demand for all exports from China, hides aren’t shipping as much as they were in 2019. But the hide market isn’t the only struggling industry—the impact disturbs the entire economy. Rahul Kappor, the vice president at HIS Markit, made the following statement: “We expect the near-term impact on trade growth in coming quarters likely to be the worst ever, as economies stall and external demand faces imminent collapse on large scale quarantine measures across major economies”.

Overall, China’s container shipments fell 10.6% in January and February of 2020 in comparison to 2019 volume. Also, a survey performed by CNTAC reported that out of the 242 companies involved, 37% had order cancellations over the last week.

For the sake of the economy at this point in time, China, as well as the world, can only hope for the number of deaths and those infected to level out so business can resume to somewhat typical volume.