11.21.2025

Sausage casings bulletin, November 21, 2025

...

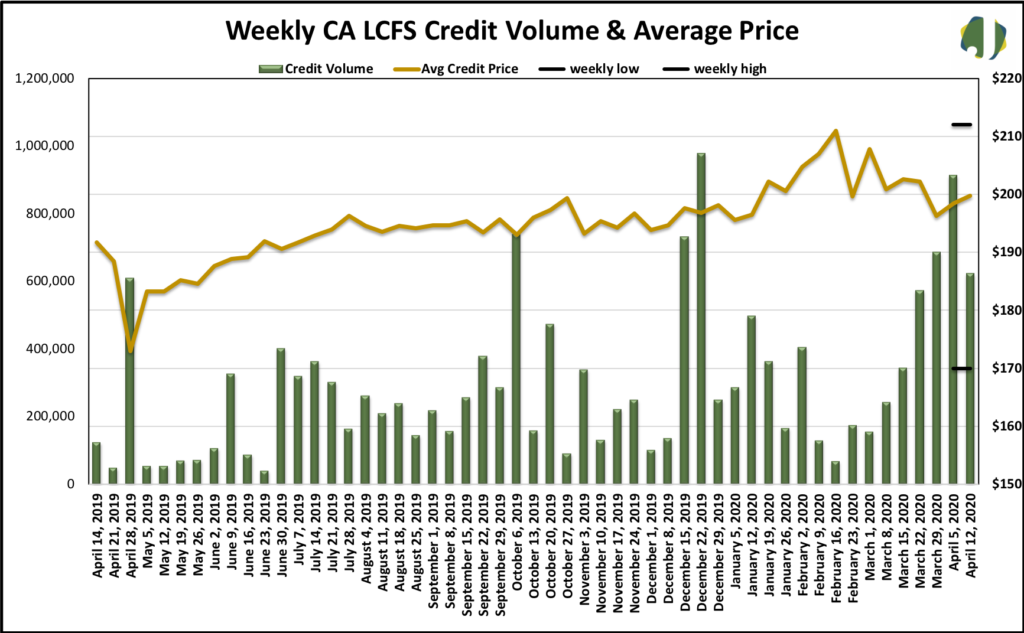

Weekly credit volume continued at a rapid pace completing the second week of the second quarter. Credit volume of 624,065 was 32 percent below last week’s total but 400 percent over the second week of Q2 2019. The average price paid per credit increased $1.31 to $199.74 as overall credit values continued to stabilize, according to data released by the California Air Resources Board (CARB). There were a record 56 transactions, 51 less than the last week. There were 14 type 1 transfers for 73,639 credits and 42 type 2 for 550,426 credits. Type 1 transactions are trades executed within 10 days of a transfer agreement. Type 2 transactions are executed beyond 10 days of a transfer agreement. The weighted average price for type 1 trades was $190.10, up from $186.50 last week. Average 2020 weekly credit volume increased to 375,182 contracts per week. Second quarter volume is 96 percent over first quarter volume and 442 percent over Q2 of 2019.

Trading was heaviest on Thursday with 32 percent of the volume transacted. The highest average daily price was $204, which occurred on Thursday. The price range credits traded in narrowed from $160 – $218 last week to $170 – $212 in this week’s report. The value of the credits transacted totaled $124.7 million, down from $181.4 million last week. At the top of the range, 17,000 credits traded for $212 and 5,000 traded for $170 at the bottom of the range. Eleven percent of the transactions occurred at a price of $210 or higher, 75 percent of the trades happened between $190 and $209.99, and 14 percent fell below $190. The value of this year’s credit transactions is 1.1 billion dollars, which is 90 percent over last year’s total of 592 million through the same weekly period. CARB has proposed to place a hard cap of $200 based on a 2016 base-year adjusted for inflation for the LCFS credit. This pending amendment is currently on schedule to become effective July 1,2020.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded 10 transfers this week for a total of 28,081 credits. CARB will exclude transfers that trade at, or near, zero in price.