11.21.2025

Sausage casings bulletin, November 21, 2025

...

We reported about the USDA funding through the Coronavirus Food Assistance Program (CFAP) recently in the Hemp Bulletin. This is the guidance USDA has offered on eligibility:

“Commodities that did not suffer a five percent-or-greater price decline from mid-January 2020 to mid-April 2020 are not eligible for CFAP. Specifically, this includes sheep more than two years old, eggs/layers, soft red winter wheat, hard red winter wheat, white wheat, rice, flax, rye, peanuts, feed barley, Extra Long Staple (ELS) cotton, alfalfa, forage crops, hemp, and tobacco. USDA may reconsider the excluded commodities if credible evidence is provided that supports a five percent price decline.” This was a departure from the statement made just two days prior.

That earlier guidance said: “However, for all commodities except for hemp and tobacco, USDA may reconsider the excluded commodities if credible evidence is provided that supports a five percent price decline.” Since then, they have amended the language, no longer explicitly excluding the two crops. Regardless of the language change, the guidance offers insight into the agencies thinking. It also shows what advocacy efforts can accomplish, namely the efforts of Jonathan Miller of the U.S. Hemp Roundtable.

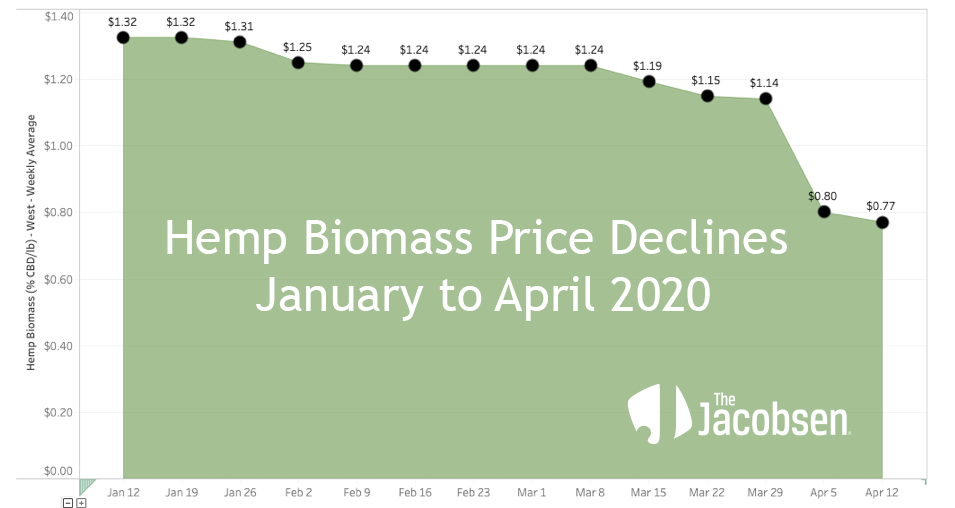

The Jacobsen – a respected agency in agricultural commodities price reporting – has been collecting pricing data for hemp since July. Our data reflect a price decline of over 13%, handily surpassing the 5% requirement required by the USDA for eligibility. We are very pleased that our efforts may benefit hemp producers, again highlighting the key role played by an objective price reporting agency. We’re arming key industry advocates with this data free of charge in hopes that hemp producers may access funding that they are both entitled to, and desperately need.

The following chart demonstrates a 42% decline in biomass pricing, but in earely April, we began reporting on organic biomass separately, which allowed us to narrow the wide price ranges significantly. Nonetheless, the data shows sufficient change to warrant access to the CFAP funds: