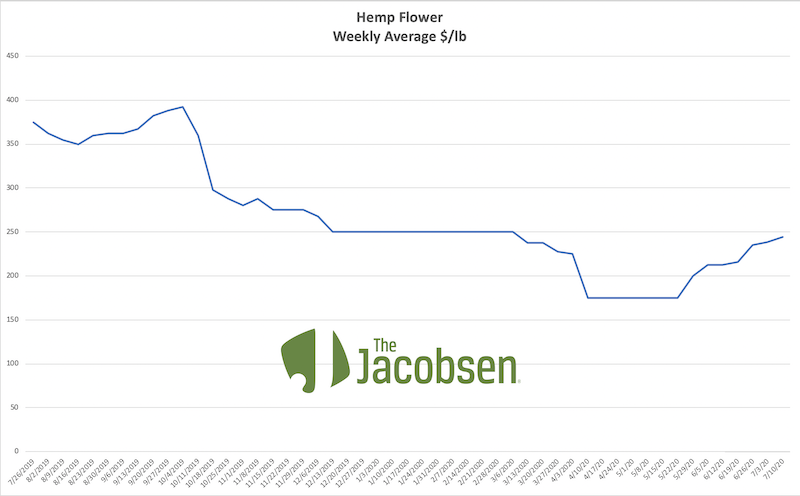

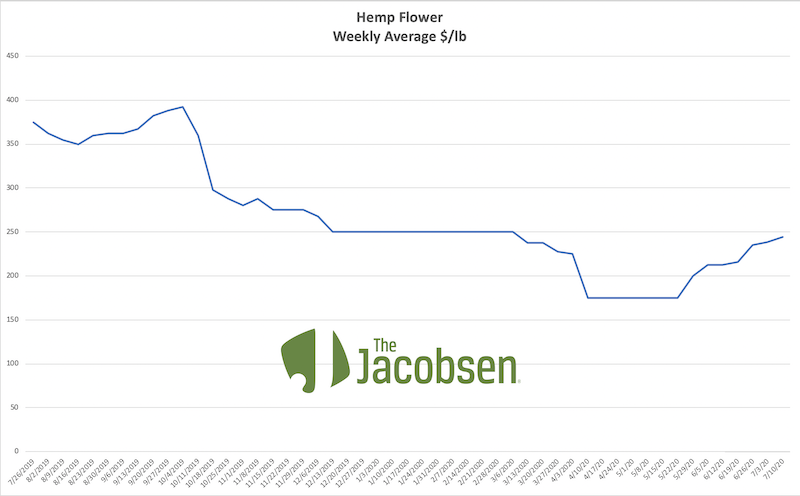

Hemp flower markets are following The Jacobsen’s forecasted trend, gaining consistently over the period since our June forecast published in late last month. The July forecast for hemp prices will be released next week. We are yet to see significant premiums with certified organic flower, but this channel is underdeveloped, there hasn’t been sufficient certified organic inventory to consistently fuel the supply chain. Quality factors, and uniqueness are key determiners for consumer demand, and “organic” is applied to much of the product on the market. “Raised organically” or “produced without any……” are commonly used in marketing language. We expect the certified organic market to expand some in 2021.

As far as demand, it is for anything but cherry anything, it seems. These varieties are still popular in parts of the fragmented markets, but these local markets will be disrupted over time with more premium or unique varieties. Supply chains have developed rapidly but markets are still underdeveloped overall, buyers are trying out new vendors, and buyers often find product not quite matching up to their expectations. The very best hand trimmed product is likely trading north of $500, but we have recently heard reports of wholesale activity in this $500/lb neighborhood, but we have yet to vet this.

Our hemp specifications, available to subscribers in the members area of The Jacobsen’s website, note:

Hemp flower is priced by the pound. The Jacobsen’s published pricing is for bucked, machine trimmed, mold free, bright green flower with a minimum 10% CBD content, below 13% moisture content. Product may be quick dried but retains a desirable terpene profile or “nose”, with abundant trichomes. Slow dried and cured flower will be represented at the top end of our published price range.

Standards for hemp flower remain variable. The market relies on subjective qualities that aren’t universal, and these aspects slow down transaction volume. This fact alone is a tremendous marketing advantage for competent producers. We should see hemp flower prices strengthen over the remainder of Q3. Q4 will usher in a new crop, with planted cultivars matched to consumer tastes. Bubba Kush, Hawaiian Haze, Sour Diesel and the like are popular varieties, but any high-terpene product with abundant trichomes will generally do well. Varieties like Lifter and Suver Haze are still showing demand, if well produced, dried, and cured, with desirable nose. The most important factor continues to be subjective quality, but counterparty confidence is also a major factor in facilitating transaction volume. Greenhouse and indoor production is ramping up, but it isn’t clear how much this supply may disrupt the current seasonal trend.

Hawaii is the latest state looking to a smokable flower ban, though it is entirely possible that the subject is being debated by legislative bodies elsewhere today. Lawmakers have increasingly sided with law enforcement, and the issue has become one of state’s rights. Indiana illustrates this aptly. The state recently won an appeal from a three-judge panel in the 7th circuit, after their smokable hemp ban was previously overturned. Indiana lawmakers need hemp flower market data to make informed decisions. Hemp flower is another economic driver and could be a revenue source for the state that recently compelled departments to cut 15% across the board. These cuts are unlikely to bridge the gap, with education being the most vulnerable remaining line item, accounting for over half the state’s budget. Providing law enforcement test kits capable of distinguishing low-THC hemp flower from high-THC MJ, paid for with a special hemp flower tax similar to other cannabis taxes, could be a win-win for the state, generating additional revenue.