04.24.2024

Biodiesel output strong in Q2; producers start locking in Q3-Q4 sales

A second producer echoed this sentiment and said they have had to work a bit harder to secure feedstock to line it up with sales at the right time.

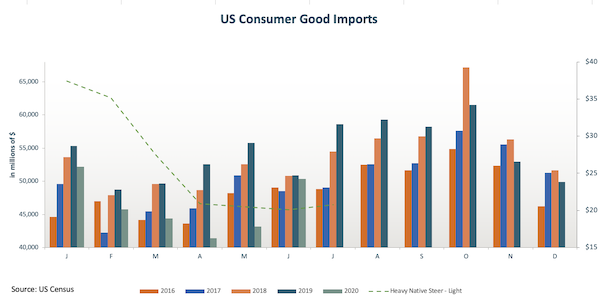

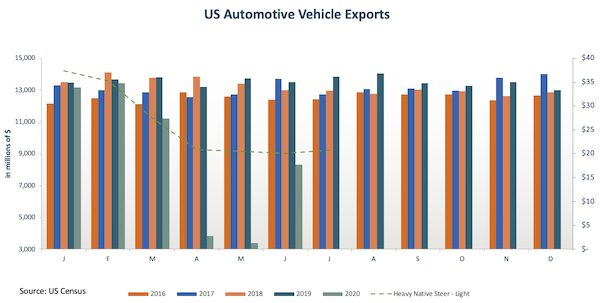

The US Census Bureau recently released updated import and export data for US Consumer Goods for June. The increases help to explain the upward price pressure the hide market has been receiving. In June, US consumer goods imports and exports increased by 16.8 percent and 12.3 percent, respectively. According to the Commerce Department, consumer spending increased by 5.6 percent in June. In particular, the department highlights that the increase in purchases was for restaurants, travel, and clothing. The Federal Reserve Economic Data reported just under a $2 billion jump for retail shoe sales in June from the record low in April of 2020. With this increase, June sales returned to levels closer to the prior four-year average of $2.7 billion in sales. US exports in June are about 25.4 percent behind the previous four-year average, but US imports have surpassed the prior four-year average by 1.1 percent. As long as businesses remain open, it’s reasonable to expect US imports and exports to continue to close the gap to pre-pandemic levels, and there is continued risk in the market for higher prices in the hides market.

Figure 1.

Figure 2.

Europe

Over the last two weeks, most tanneries in both Northern and Southern European countries were closed due to summer vacation. Therefore, the number of closed trades was particularly low, except for raw and salted bulls from France, Germany and Poland, that were sold at last-traded prices.

Some tanneries in Northern Europe will reopen this week, while in the south of Europe (including Italy) industrial plants will remain closed until the end of August. Several tanners have confirmed that this year they’ve decided to prolong the summer closing, due to the lack of orders for finished leather.

It is expected to be seeing more material movement over the next two weeks, but the market remains uncertain due to the latest developments of the Covid-19 pandemic. Although the medical situation is still under control, there is a constant increase of new cases in key countries like Germany and France. At the moment, new lockdowns are unlikely, but if the situation worsens new rules of social distancing might be implemented which this is not good for business.

Prices of all main European material remain steady – at very low levels. The European hide market needs some positive news in order to bounce back up, such as a Covid-19 free Europe and an increased industrial production. The hope is that it will not take too long to achieve this result.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**

August 19 (The Guardian) – Italy at a crossroads as fears grow of Covid-19 second wave