04.23.2024

Rising BOHO spread spurs RIN values higher

Despite the move higher, D4 RINs are down 2% in value from the previous week. RIN prices are receiving support from the rising bean oil/heating oil (BOHO) spread, which...

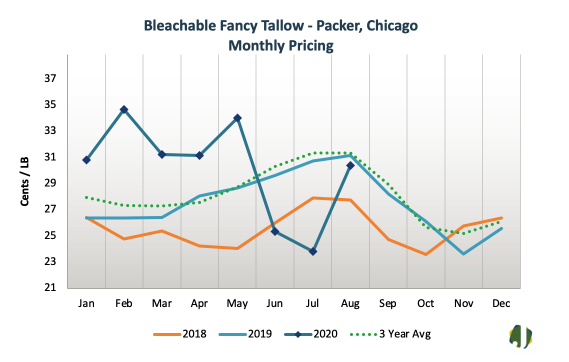

The week came to a quiet close with no trading reported today. There were indications that both grades of bleachable fancy tallow (BFT) were offered out at higher prices, but thus far, there has been little interest to pay higher prices. Historically, September has ushered in a period of lower prices to the BFT market. Prices in September haven’t increased relative to August since 2012, and the average move since then has been a negative 2.14 cents per pound for the Chicago packer market. October prices have averaged a drop of 4.09 cents per pound relative to September over the same period. A seasonal reduction in demand from the oleochemical sector and the unfavorable cold weather characteristics of tallow into biodiesel have driven this decrease. This year is unique in many ways, from the ubiquitous effects of COVID-19 to the more defined increases in demand from the renewable fuel sector, both in the North American market and international. A resurgence in demand for personal care products could drive a fourth-quarter rally, and the risk for volatility remains as new buyers have shown interest in the US tallow market, particularly Brazil. Buyers should be cautious in managing their positions and not assume that a downturn is inevitable based on recent history given that the number of variables affecting the market this year, and likely through the remainder of this year, that are without precedent.

Figure 1.

Please contact Ryan Standard at 331.276.8227 or [email protected] with any questions, comments, or trading.

Broiler-fryer slaughter under federal inspection for 28-Aug-20 and 29-Aug-20 is estimated to be 36,439,000 head down 2.05 percent from a week ago and down 8.3 percent from a year ago.(Last week 37,202,000, last year 39,720,000)

Weekly broiler-fryer slaughter under federal inspection for the week ending 29-Aug-20 is estimated to be 171,870,000 head up 0.48 percent from a week ago, and down 3.39 percent from a year ago.(Last week 171,052,000, last year 177,907,000