Biomass-Based Diesel Imports Climb in June- EIA

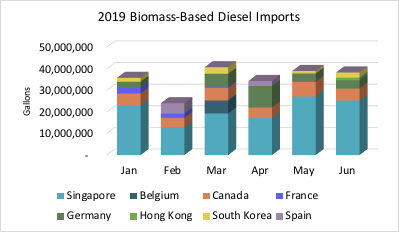

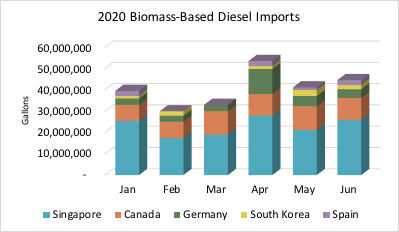

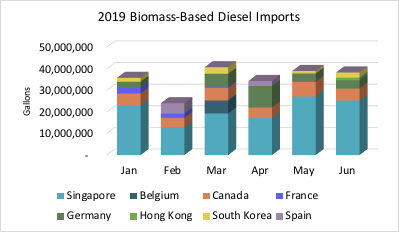

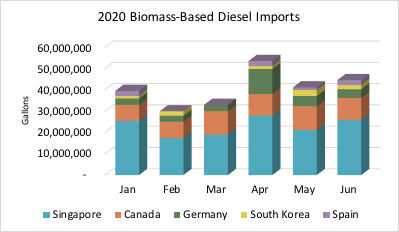

According to the Energy Information Agency (EIA), the United States imported 44.56 million gallons of biomass-based diesel (D4) during June. Imports of D4 were eight percent over May and 17 percent above the volume imported in June of 2019. D4 imports this year have reached 241.7 million gallons, 14.1 percent over 2019 volume through the same time period.

June biodiesel imports were six percent below May, but 44 percent over June of 2019. Biodiesel imports were received from Canada, Germany, South Korea and Spain. Canada was the leading exporter, providing 10.3 million gallons or 55 percent of the volume while Germany shipped 4.1 million gallons, or 22 percent of the total. Cumulative 2019 biodiesel imports have reached 105.1 million gallons and are 20 percent over 2019 shipments during the first half of the year.

Renewable diesel imports increased during June, climbing 22 percent above May and two percent over June of 2019. Singapore is the only country currently exporting renewable diesel to the US. Year to date renewable diesel imports are 136.6 million gallons and 10 percent over the 2019 import pace during the same time period.

Imports could see higher volumes this year. The 10th Circuit Court ruling on small refinery exemptions (SREs) granted by the Environmental Protection Agency (EPA) could lead to increased import interest. The extension of the blenders tax credit will also make the US a favorable destination for biomass-based diesel from other countries. The lingering impact of the pandemic will offset some import activity. Refiners have been petitioning the EPA for prior year hardship exemptions in an effort to get around the 10th circuit court ruling.

Low carbon fuel programs in California and Oregon are attracting large amounts of renewable fuels, especially renewable diesel due to fuel credits trading at high levels. Other states such as Colorado, New York, Washington, and Utah are considering adding similar programs, which could further impact import growth.