11.21.2025

Sausage casings bulletin, November 21, 2025

...

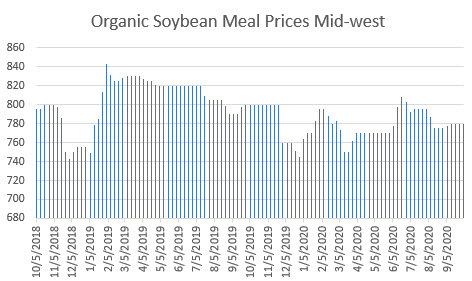

Organic soybean meal prices continue to remain buoyed as shipments costs from India have buoyed prices. Merchandiser is quoting organic soybean meal close to $690 per short-ton customs cleared in the Baltimore region. This comes as containers continue to be difficult to find and shipping rates move higher. The issue is a supply chain problem more than a harvest issue in India. In fact, according to local sources, even with the rains that are expected to damage a good portion of the soybean crop this year, the volume of organic will likely rise. Initially, the Jacobsen believed there would be an increase to nearly 11.5 million metric tons of soybean production in India for the 2020/2021 marketing year.

The rains have likely reduced the volume down to somewhere near 9/9.5 million metric tons of production. This is likely up more than 15% year over year for the 2020/2021 season. Local merchandisers believe the volume of organic soybeans that will be produced will be up a smaller 3-5% year over year compared to the same period in 2019/2020.

Organic pea prices have remained stable despite the strong demand for organic pea isolate. Organic meat sales have been on the rise for most of the period that covers the spread of COVID-19. According to Beyond Meat, which plans to add its products to nearly 2,400 Walmart stores soon in a significant expansion of the partnership between the two companies. Demand for plant-based protein alternatives such as the Beyond Meat Burgers has increased 25% year over year. This comes just as Beyond Meat plans to increase its distribution to Walmart.