11.21.2025

Sausage casings bulletin, November 21, 2025

...

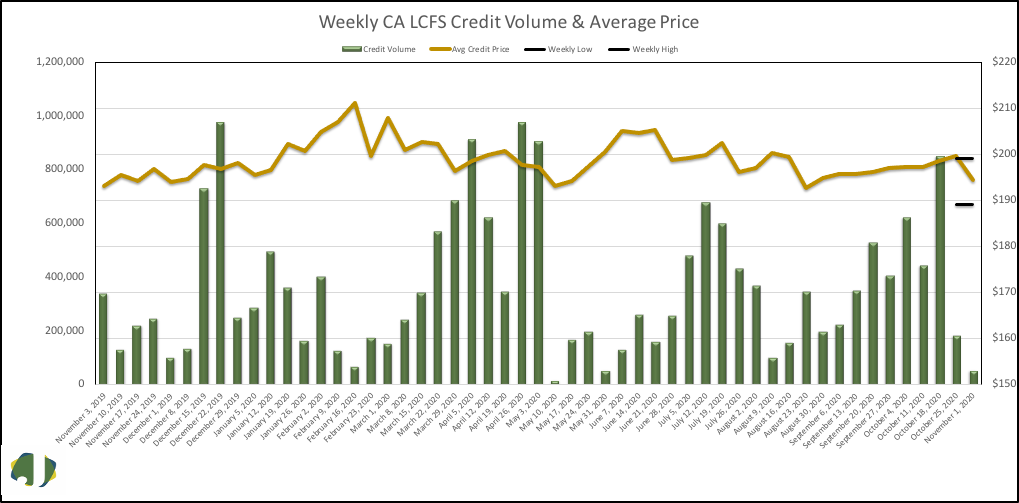

Weekly LCFS credit volume of 52,297 was 86 percent below the average weekly credit volume for the year and 130,925 fewer credits than were traded the week prior. Credit volume reached a 25-week low and was 85 percent below last year’s total for the same period. The average price paid per credit dropped $5.34 to $194.34. There were 12 transactions, 49 percent of the credit volume were type 1 transfers of 25,534 credits and type 2 transfers accounted for 119,903 credits, or 51 percent of the volume. Type 1 transactions are executed within 10 days of an agreement. Type 2 transactions are executed beyond 10 days of a transfer agreement. Type 1 transactions may give a better indication of current market conditions since Type 2 transactions do not provide a date the agreement was entered into. The weighted average price for type 1 trades was $195.37, $1.03 over the average for all trades. Fourth quarter volume is 16 percent below third quarter volume but 20 percent over Q4 of 2019.

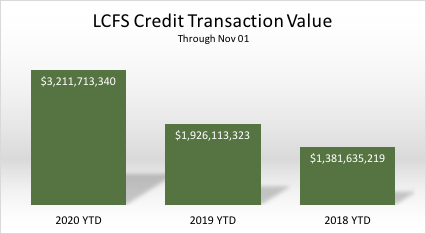

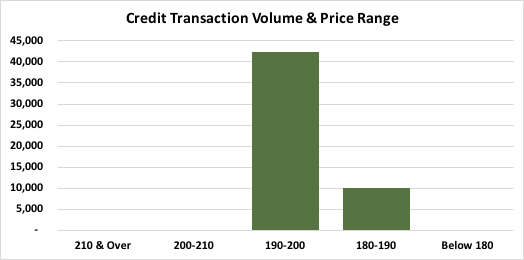

Trading was heaviest on Thursday, October 29, with 34 percent of the volume transacted. The highest average daily price was $197, which occurred on Friday. The price range credits traded in narrowed from $190 – $215 last week, to $189 – $199 this week. The value of credits transacted totaled $10.2 million, down from $36.6 million last week. At the top of the range, 892 credits traded for $199 and 10,000 traded for $189 at the bottom of the range. Eighty one percent of the weekly volume traded between $194 and $199. Nineteen percent of the weekly volume traded at $189. The value of this year’s credit transactions is $3.2 billion, which is 67 percent over last year’s total of 1.9 billion through the same weekly period. The value of credits transacted in 2020 exceeds the value for all of 2019. CARB has placed a hard cap of $200 based on a 2016 base-year adjusted for inflation for the LCFS credit. This limits transactions to a price of $217.97. The Cap will be updated once a year on June 1st.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded five transfers totaling 8,102 credits. CARB will exclude transfers that trade at, or near, zero in price.