06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

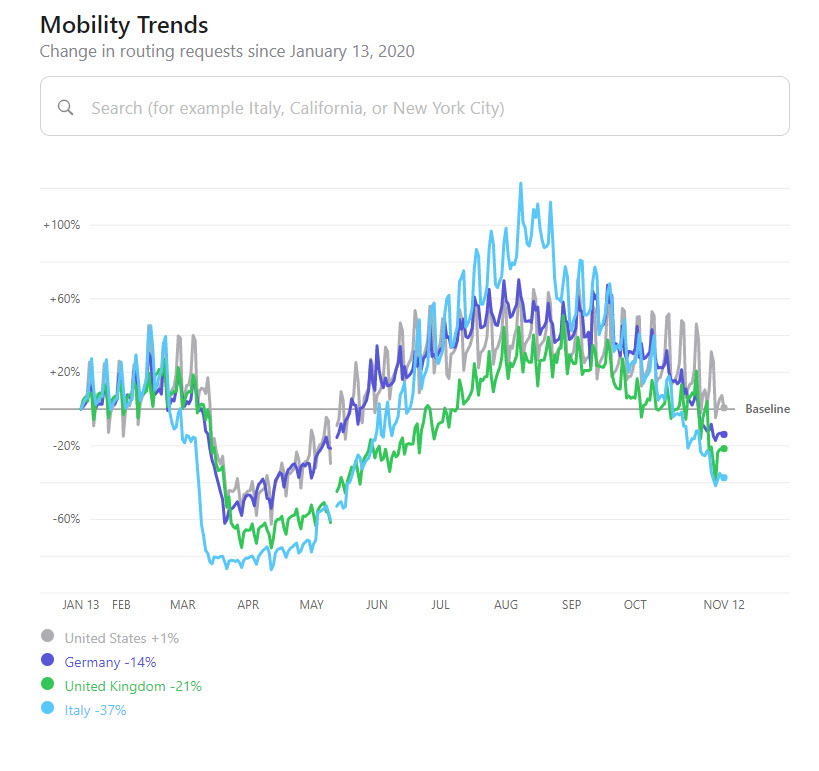

As the second wave of COVID has started to spread around the United States, with the number of cases rising by more than 100K for 8-consecutive days, food stockpiling is occurring again. Apple mobility shows that people started reducing their movement beginning in August and the US movement is back to levels seen in February. Germany, the United Kingdom, and Italy are down 14%, 21%, and 37% compared to the pre-pandemic baseline. The drop in mobility in the US coincides with the surge in grocery-store shopping and the demand for organic products.

Signs point to another round of stockpiling already starting. According to Bloomberg, demand for items like baking goods spiked 3,400% from a year earlier in the three weeks through October 13. This compares to the 6,000% jump that preceded the first wave of pantry loading, but this one to hit a wider range of products beyond canned goods and other staples.

Many of the food makers are prepared. General Mills Inc., the maker of Cheerios and Annie’s boxed mac and cheese, added 45 external productions. Campbell Soup Co. spent $40 million to expand the production of Goldfish crackers. Conagra Brands Inc. boosted third-party manufacturing and warehousing, while Stonyfield Farm, a producer of organic dairy products, is buying more milk from its direct supply network of farms.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...