11.21.2025

Sausage casings bulletin, November 21, 2025

...

The US hide market had a somehwat slow day ahead of the Thanksgiving break. The auto industry continues to drive demand for Heavy Native Steer (HNS) and Butt Branded Steer (BBS). Hide prices for jumbo HNS and all weight categories for BBS have seen a jump from yesterday’s levels.

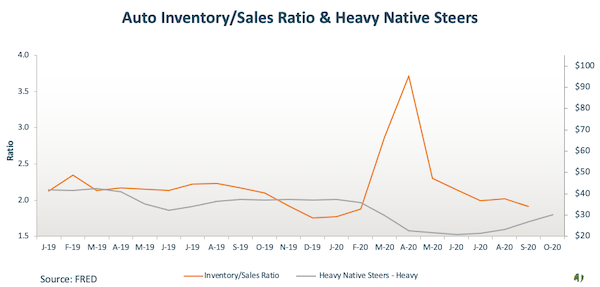

September Federal Reserve Economic Data (FRED) for Auto Inventory to Sales Ratio were released recently, showing a drop to 1.91, down from 2.02 in August. The ratio is also down from the prior five year average of 2.4 for September and has been on a steady decline since an eleven year high of 3.7 in April of this year. The large number of unsold autos can reasonably be attributed to a big drop in consumer spending during the early outbreak of COVID-19 this year. The increase in unsold autos is tied to the big drop in heavy native steer (HNS) hide prices, which fell to an all-time monthly average low of $20.85 per piece in June. As the ratio of inventory to sales has decreased, hide prices have increased on improved demand from the auto sector. HNS closed the month of October at an average price of $30.08 per piece, up 44 percent from June. The Jacobsen is forecasting the HNS market to close November just shy of $34 per piece. Fresh restrictions tied to rapid growth in COVID-19 cases across the US pose a risk for additional slowdowns in auto demand, which could spill into the hide market. Well sold positions and continued strong demand for hides through December offset some of that risk in the near term.

Figure 1.

HNS 74/76 @ $44.00 OR 0.4575

BBS 66/68 @ $37.00 OR 0.4300

BBS 62/64 @ $37.00 OR 0.4575

BBS 74/76 @ $41.00 OR 0.4275

HNS 70 MIN @ $38.00 OR 0.4225

BBS 62/64 @ $29.00 OR 0.3600

BBS 66/68 @ $29.00 OR 0.3375

BBS 70 MIN @ $33.50 OR 0.3725

The offices of The Jacobsen will be closed tomorrow, November 26 and Friday, November 27 in observance of the Thanksgiving Day holiday. The Daily North American Hide Bulletin will not be published on tomorrow or Friday.