11.21.2025

Sausage casings bulletin, November 21, 2025

...

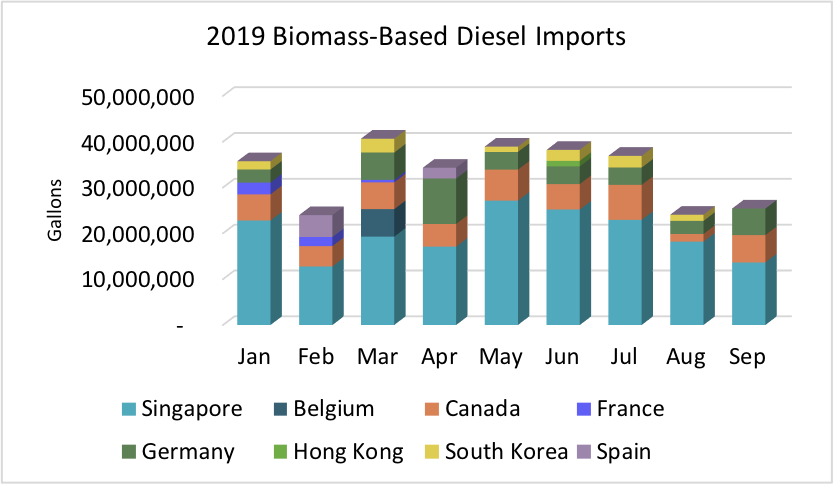

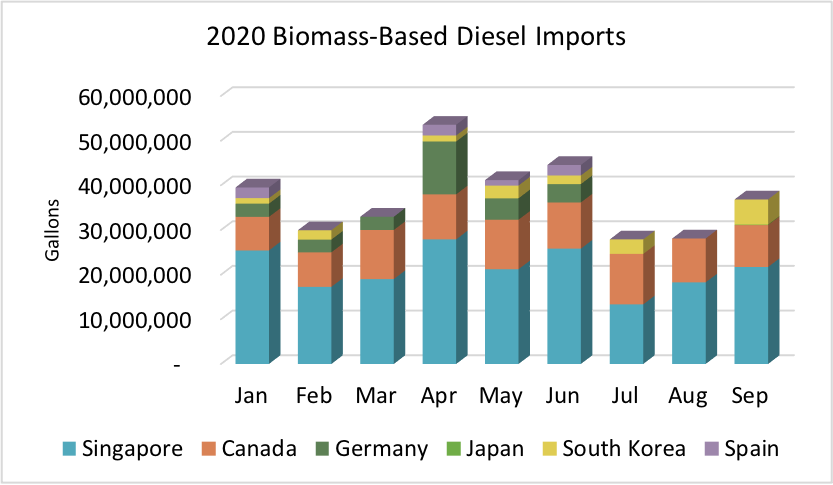

According to the Energy Information Agency (EIA), the United States imported 36.8 million gallons of biomass-based diesel (D4) during September. Imports of D4 were 31 percent over August and 45 percent above the volume imported during September of 2019. D4 imports have reached 334.5 million gallons in 2020 and are running 12.2 percent over the 2019 import pace through the same time frame. Renewable diesel imports outpaced biodiesel imports during September, as they have done every month other than July.

September biodiesel imports of 15.1 million gallons were 54 percent over August, and 29 percent above the amount received in September of 2019. Biodiesel imports arrived only from Canada, South Korea, and Japan this month. This is the first time this year Japan has shipped biodiesel to the US. Cumulative 2020 biodiesel imports have reached 144.6 million gallons and are 21.3 percent over 2019 shipments during the same time period.

Renewable diesel imports moved higher for a second consecutive month. Imports climbed 19 percent to 21.7 million gallons and were 59 percent above the amount received during September of 2019. Singapore is the only country currently exporting renewable diesel to the US. Year to date renewable diesel imports are 189.9 million gallons and 6.1 percent over the 2019 import pace during the same time period.

Imports have been arriving at an increased pace relative to 2019 when the US imported 426.1 million gallons of biomass-based diesel. Renewable diesel imports are on pace to reach an all-time high in 2020, while biodiesel imports may be at their highest level since 2017 when imports from Argentina were halted. The January ruling by the 10th Circuit Court of Appeals on small refinery exemptions (SREs) granted by the Environmental Protection Agency (EPA) could lead to increased import interest going forward. The extension of the blenders tax credit will also make the US a more interesting destination for biomass-based diesel from other countries.

Low carbon fuel programs in California and Oregon are attracting large amounts of renewable fuels, especially renewable diesel due to fuel credits trading at high levels. Other states such as New York, Washington, and Utah are considering adding similar programs, which could further impact import growth.