11.21.2025

Sausage casings bulletin, November 21, 2025

...

Fund Spreading Drives Soybean Oil Sharply Higher

Soybean oil prices jumped higher on Friday on the liquidation of short oil share positions by funds despite a decline in soybean futures. Following the Indonesian government’s announcement of an increase in palm oil exports’ tax rate, expectations of higher exports contributed to the bullish tone, as did gains in energy prices.

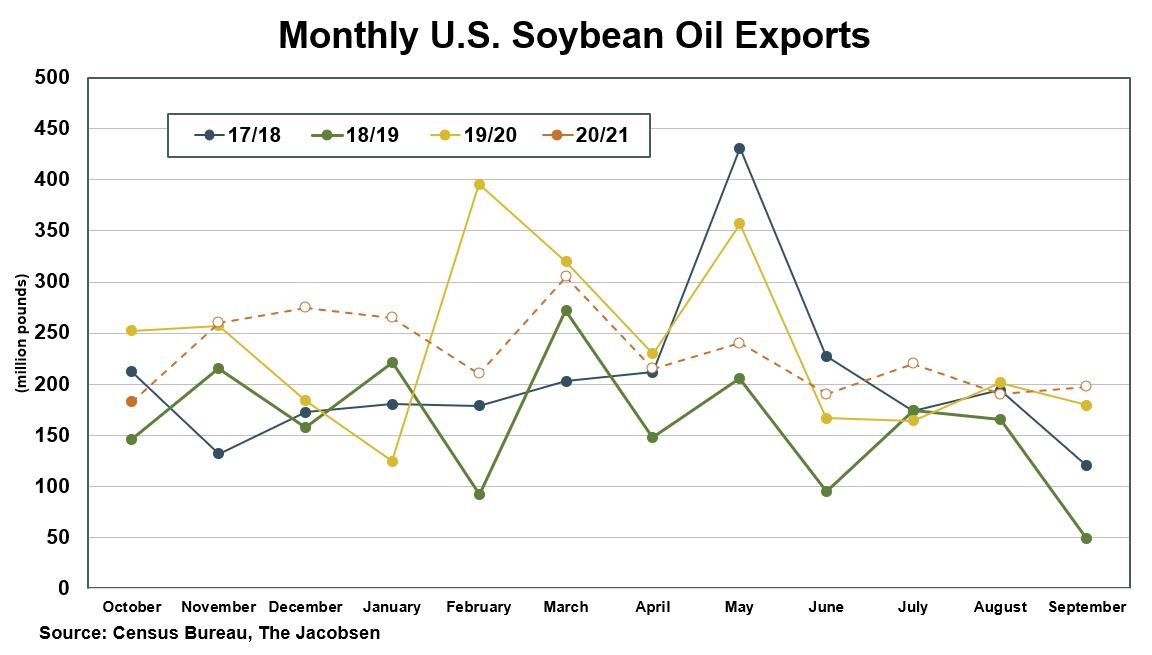

The Census Bureau released its monthly export data for October, indicating that U.S. soybean oil shipments totaled 183 million pounds. The total was just above 179 million pounds shipped in September but 70 million pounds below the 253 million shipped last year. October exports were well below the 230 million pounds suggested by shipments’ seasonal pattern and Jacobsen’s 2020/21 U.S. soybean oil export forecast of 2.75 billion pounds. However, given the spread between soybean oil and palm oil values and the level of export commitments through November 26, The Jacobsen will not make any changes to its marketing-year prediction.

Soybean oil futures gained about 1 1/2 percent (January contract +68 basis points per pound), but gains in deferred contracts were smaller (January 2022 contract +52 basis points). The rally drove the benchmark price back above the 38-cent level. However, selling above the life-of-contract high left the contract to settle just below that level. The Jacobsen expects short-term resistance at the life-of-contract high (38.51 cents), the 39-cent level/intraday high (39.02 cents), and the upper Bollinger band (39.24 cents). Support is likely just below the 38-cent level where the five-day exponential, 10-day, and 15-day moving averages converge, the 20-day moving average (37.36 cents), and the 37-cent level.

Palm oil prices rose more than three percent (February contract +105 ringgit per tonne) on the overnight strength in soybean oil futures and gains in energy prices. The rally drove the benchmark contract above the 3,400-ringgit level and to a fresh life-of-contract high. The move left the continuous most actively traded contract at its highest level since May 2012. Expectations that palm oil inventories continued to tighten in November, as reflected in a survey ahead of the monthly supply and demand data from the Malaysian Palm Oil Board (MPOB) contributed to the gains. The move left the benchmark contract above the upper Bollinger band and drove the spread between soybean oil and palm oil back to the recent lows, which could trigger short-term weakness.

The Jacobsen expects short-term support at the 3,400 ringgit, the five-day exponential moving average (3,359 ringgit), and around the 3,300 ringgit level, where the 10-day, 15-day, and 20-day moving averages converge. Resistance is likely above the upper Bollinger band (3,425 ringgit), the 2012 closing high (3,471 ringgit), and 3,500 ringgit.