11.21.2025

Sausage casings bulletin, November 21, 2025

...

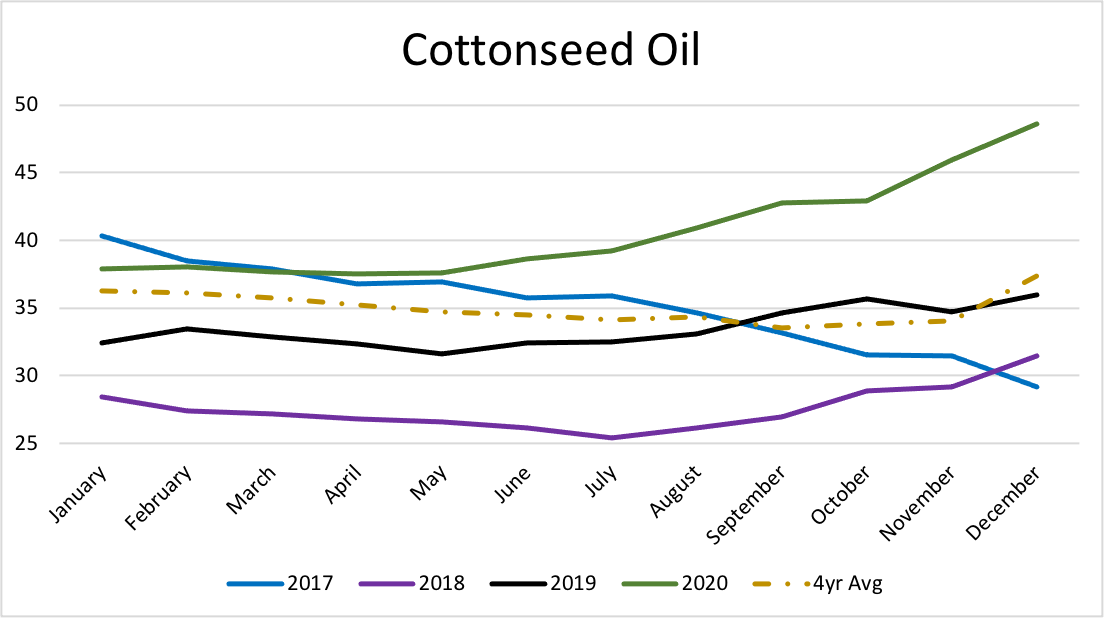

Cottonseed oil prices are rising to multi-year highs. A global move in vegetable oil pricing due to increased demand and questions surrounding supply have pressured prices higher. This has been true for cottonseed oil as well.

The cotton harvest is wrapping up in the US, but it was much smaller in west Texas than some had anticipated. Dairy farmers have increased their demand for whole seed in feed rations, increasing the price of cottonseeds and leaving cottonseed crushers in a non-competitive situation for seed. Crushers have lost much of their supply to the dairy market, which has reduced the amount of cottonseed oil (CSO) available to the market and has suppliers running up prices and/or not offering product out beyond the March/June time frame. In the Southeast and Mid-South, high FFA’s in the seed have added to refining losses and further limiting supply.

Factoring in a strong global vegetable oil market we are seeing prices stretch to heights not seen since 2012 when US agricultural sector was affected by a severe drought. Cottonseed oil prices have averaged higher prices in each of the past eight months. Novembers average price was 46 cents per pound, which was 11 cents more than it was in November of 2019 and 16 cents per pound above the four-year average of 34 cents. December is seeing prices continue to climb with values averaging nearly 49 cents per pound over the first half of the month. Prices are 12 cents per pound above the four-year average and will likely be trading around 54 cents per pound by year end.