11.21.2025

Sausage casings bulletin, November 21, 2025

...

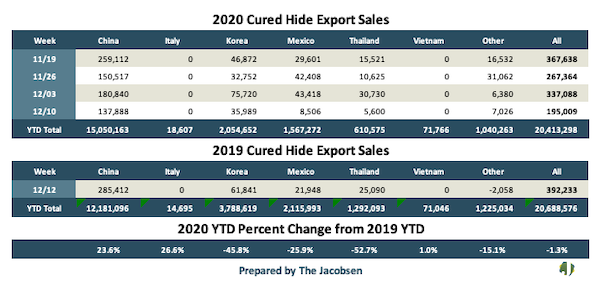

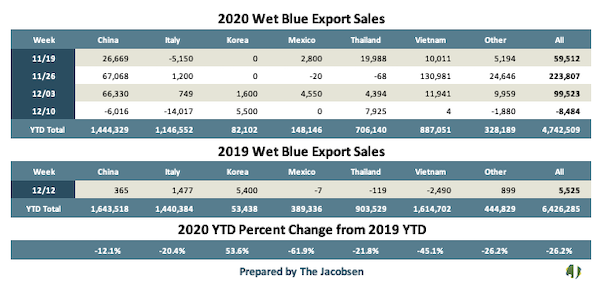

Hide prices traded sideways today, as the holiday week has been relatively quiet throughout the marketplace. Mid and low-end hides remain firm, but after price drops yesterday, the steer material seems to be receiving pressure to withhold upward moving pricing.

Europe

Europe is facing an unexpected resurgence of the Covid-19 pandemic, possibly related to the spread of the newly discovered virus variant in the United Kingdom. The number of new cases remains high and health care systems are under pressure. Therefore, restrictive measures including lockdowns, shops closing, and night curfews will be implemented in most of Europe. Surely this is not a positive development, but at the moment it is not possible to understand the exact impact of this situation on European industrial production.

Most tanneries are now closed because of the upcoming Christmas vacation, and we will have to wait until next year to see in which direction the hide market will move. Over the last two weeks there has been a confirmation of the tendency we have already noticed during the last months: the demand for upholstery (especially mid-low quality) and automotive is steady, while the general lack of demand for footwear and leather goods articles is not showing any sign of improvement.

German, French, and Polish bull price increased between 0,05€ and 0,10€ compared to what previously reported, due to a decreasing amount of slaughtered cattle as well as a steady demand.

European calf price did not change and the number of closed trades remains extremely low, even though some material has been sold to buyers located in the Far East.

Polish Ox/Heifer price is reported steady.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**

No packer sales today.

No processor sales today.