11.21.2025

Sausage casings bulletin, November 21, 2025

...

Heavy Native Steer (HNS), Heavy Native Dairy Steer (HNDS) and Dairy Cow (DC) hide demand has been firm due to the strong furniture upholstery business. The majority of hide buying in the US is with immediate shipment or into February.

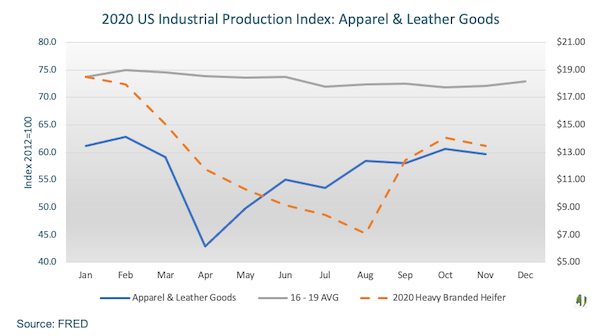

November Federal Reserve Economic Data (FRED) were released for the Industrial Production Index for apparel and leather goods reporting a 1 percent decrease the prior month’s report and a 21 percent decrease from the prior four-year average for November. The index did mover 39 percent higher from April to November, but the impact of the recession is evident with the index trending below the prior four-year average throughout the year. Industrial production was significantly lower in 2020 as shelter-in-place orders contributed to reduced demand for apparel and leather goods.

November FRED data were released for advance retail sales for clothing, showing a 17 percent decrease from the prior four-year November average. The increase in demand for clothing increased by 130 percent since April’s low. If demand for apparel and leather goods continues to grow and the vaccine continues to be more widely available, it is reasonable to expect both indices to close the gap the prior four-year average.