11.21.2025

Sausage casings bulletin, November 21, 2025

...

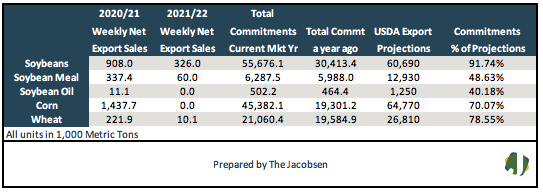

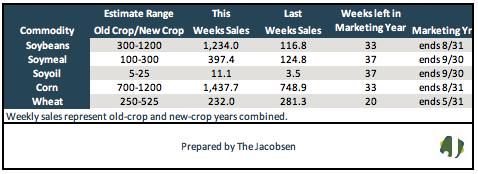

Weekly soybean export sales for the 2020/21 marketing year of 908 thousand metric tons (TMT), a marketing year low, were 871 TMT above last week’s total and 93 percent over the four-week average of 471 TMT. There were 326 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 1,234 TMT. Combined crop year sales were significantly over last week’s total and exceeded analyst estimates that ranged from 300 to 1,200 TMT. 2020/21 export commitments are 92 percent of the revised USDA forecast. Export sales are 83 percent above the 2019/20 crop year pace. Major purchases were reported for Mexico, China, and Spain.

Soybean meal sales for the 2020/21 marketing year of 337.4 TMT, a marketing year high, were 213 TMT over last week and 97 percent above the prior four-week average of 171 TMT. There were 60 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 397.4 TMT. Combined crop year sales were 218 percent above last week’s report and exceeded analyst expectations that ranged from 100 to 300 TMT. Accumulated export commitments are 49 percent of forecast. Sales are five percent above last season’s pace. Major purchases were made by Vietnam, El Salvador, and the Philippines.

Soybean oil 2020/21 export sales of 11.1 TMT were 7.6 TMT above last week’s volume but 52 percent below the four-week average of 23 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales at 11.2 TMT. Combined season sales were within analyst expectations that ranged from 5 to 25 TMT. 2020/21 marketing year commitments are 40 percent of forecast and need to average 20 TMT per week to meet projections. Soybean oil sales are eight percent above last season’s pace. Major purchases were made by Mexico, Guatemala, and Canada.

Weekly corn export sales for the 2020/21 marketing year of 1,437.7 TMT, were 689 TMT over last week and 34 percent above the prior four-week average of 1,072 TMT. No sales were recorded for the 2021/22 crop season, leaving total sales to 1,437.7 TMT. Combined sales were 92 percent over last week and exceeded analyst expectations that ranged from 700 to 1,200 TMT. Increases were reported for Mexico, Japan, and Columbia. 2020/21 export commitments are 70 percent of the USDA’s latest revised forecast. Export sales this season are 135 percent over the 2019/20 pace.

Wheat export sales for the 2020/21 marketing year of 221,900 metric tons, were 53 TMT below last week’s volume and 49 percent under the prior four-week average. There were 10.1 TMT in sales recorded for the 2021/22 crop season, lifting total sales to 232 TMT. Combined sales were 18 percent below last week’s and below analyst expectations that ranged from 250 to 525 TMT. Export commitments are 79 percent of the 2020/21 USDA forecast and need to average 288 TMT per week to meet projections. Sales are eight percent above last year’s pace. Major purchases were made by Bangladesh, Malaysia, and Mexico.