06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

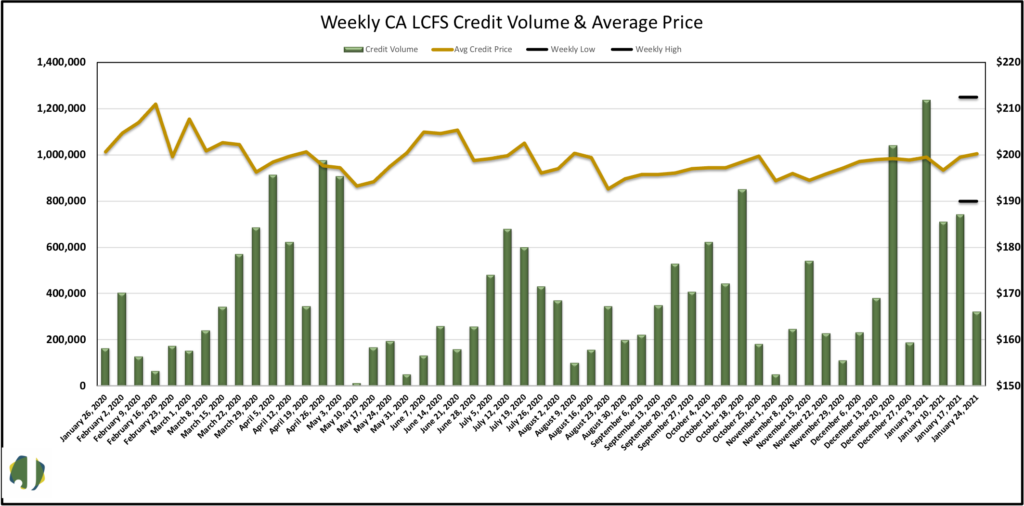

Weekly LCFS credit volume slowed during the third week of the month, but the current pace is 73 percent stronger than what was initially seen in 2020. Credit volume during the week ending January 24 of 851,528 was 56 percent below last week and 16 percent under the same weekly period in 2020. First quarter 2021 volume is seven percent below Q4 2020 but 73 percent above Q1 2020. The average price paid per credit increased $0.72 to $200.27. There were 39 transactions, 13 were type 1 transfers of 64,767 credits and 26 were type 2 transfers totaling 259,090. Type 1 transactions are executed within 10 days of an agreement. Type 2 transactions are executed beyond 10 days of a transfer agreement. Type 1 transactions may give a better indication of current market conditions since Type 2 transactions do not provide a date the agreement was entered into. The type 1 transfers had a price range of $199 to $201.50 and an average price of $200.61

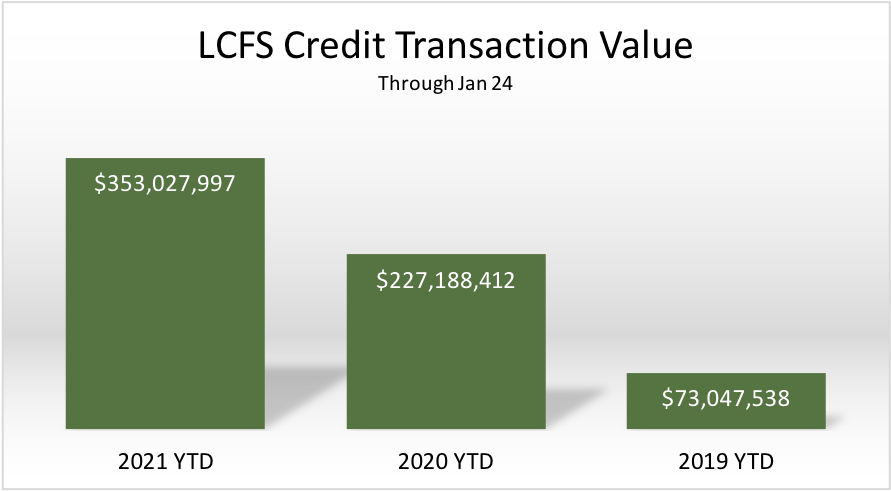

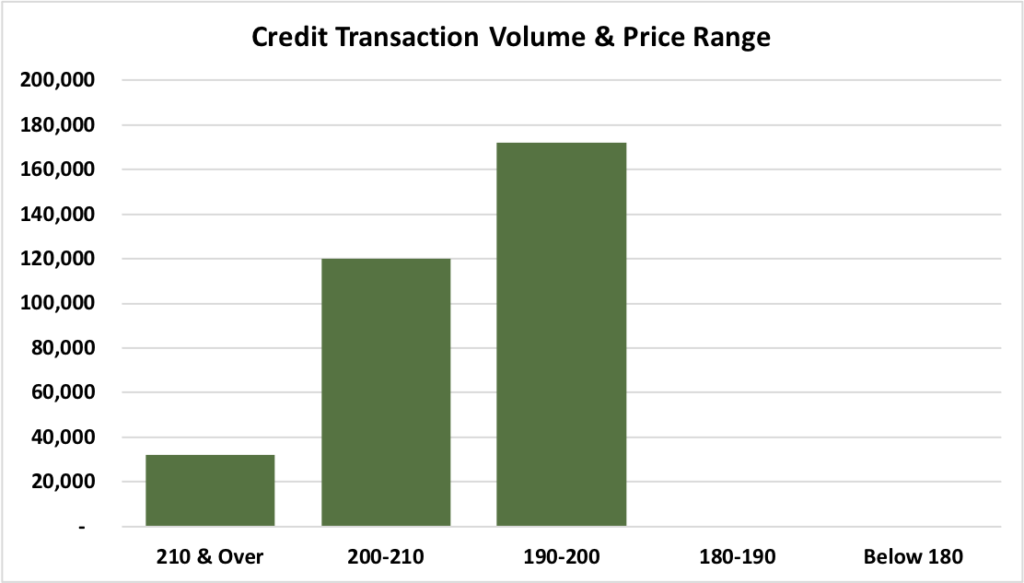

Trading was heaviest on Tuesday, January 19, with 45 percent of the volume transacted. The highest average daily price was $20, which occurred on Friday. The price range credits traded in narrowed from $170 – $212 last week, to $190 – $212.50 this week. The value of credits transacted totaled $64.8 million, down from $148 million last week. At the top of the range, 10,000 credits traded for $212.50 and 5,000 traded for $190 at the bottom of the range. Ten percent of the transactions occurred at a price of $210 or higher, 90 percent of the volume traded between $190 and $209.99 and zero percent was transacted below $190. The value of this year’s credit transfers is $353 million, which is 55 percent over last year’s total through the same period. CARB has placed a hard cap of $200 based on a 2016 base-year adjusted for inflation for the LCFS credit. This limits transactions to a price of $217.97. The Cap will be updated once a year on June 1st.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...