Soybean Oil Prices Rally Despite Decline in Soybean Futures

Vegetable oil prices were mixed on Friday as fund spreading lifted the front-end of the soybean oil curve despite a decline in soybean futures. The decline in soybean oil futures on Thursday and weakness in vegetable oil prices on the Dalian exchange weighed on palm oil futures. Residual selling following cargo surveyor data for the first 25 days in February also weighed on palm oil values. For the month, the benchmark soybean oil contract rose slightly more than six cents (13.7 percent) after gaining more than 2 1/4 cents in January. The benchmark palm oil contract gained 377 ringgit (11.2 percent) in February. Bullish world vegetable oil fundamentals and record prices in some cash markets contributed to the substantial gains in both markets.

The spread between the May soybean oil and palm oil contracts rose back above eight cents, but it has generally been range-bound between seven and eight cents since the middle of the month. The July spread rose slightly above 9 3/4 cents per pound. Like the May spread, the July spread has been range-bound since the middle of the month, trading between nine and 10 cents. The sharp rise in the spread has slowed the demand for U.S. soybean oil exports and contributed to the recent weakness in the Gulf basis.

A sharp decline in energy prices drove the spread between soybean oil and heating oil above $1.95 per gallon, the highest it has been since March 2008. In 2008, the spread peaked above $2.40 per gallon in February but fell below 50 cents per gallon by October. Given the world vegetable oil fundamentals, it may be difficult for the spread to move substantially lower in the short-term. However, capital has flowed into the energy markets as a hedge against rising inflation and in anticipation of a recovery in economic activity as governments ease restrictions put in place to slow the spread of the coronavirus. As more of the South American soybean crop comes to market, the potential for the spread to weaken due to rising energy prices and weakness in vegetable oils will increase. Still, in the short term, upside price risk will be more significant for the spread than downside risk.

Nearby soybean oil futures rallied more than 1/2 percent (May contract +27 basis points per pound). However, selling in the benchmark contract above the psychologically critical 50-cent level limited gains and left the benchmark contract just below 50 cents. At the opening of the U.S. session, buying below the 49-cent level reversed sharp overnight declines. The benchmark contract tested 49 cents within the first hour of the U.S. session but rallied steadily throughout the day to settle just below the session high.

Bull spreading left the back end of the soybean oil curve unchanged or marginally lower (January contract -2 basis points), driving the March/December spread to a life-of-contracts high just above seven cents. The strong domestic demand, which has driven interior basis levels to multi-year highs, pushed spreads sharply higher over the past week, with the March/December spread rising more than two cents. Anecdotal reports suggest the strength in domestic demand may be due, in part, to the increase in feedstock demand from new plants in the biomass-based diesel industry.

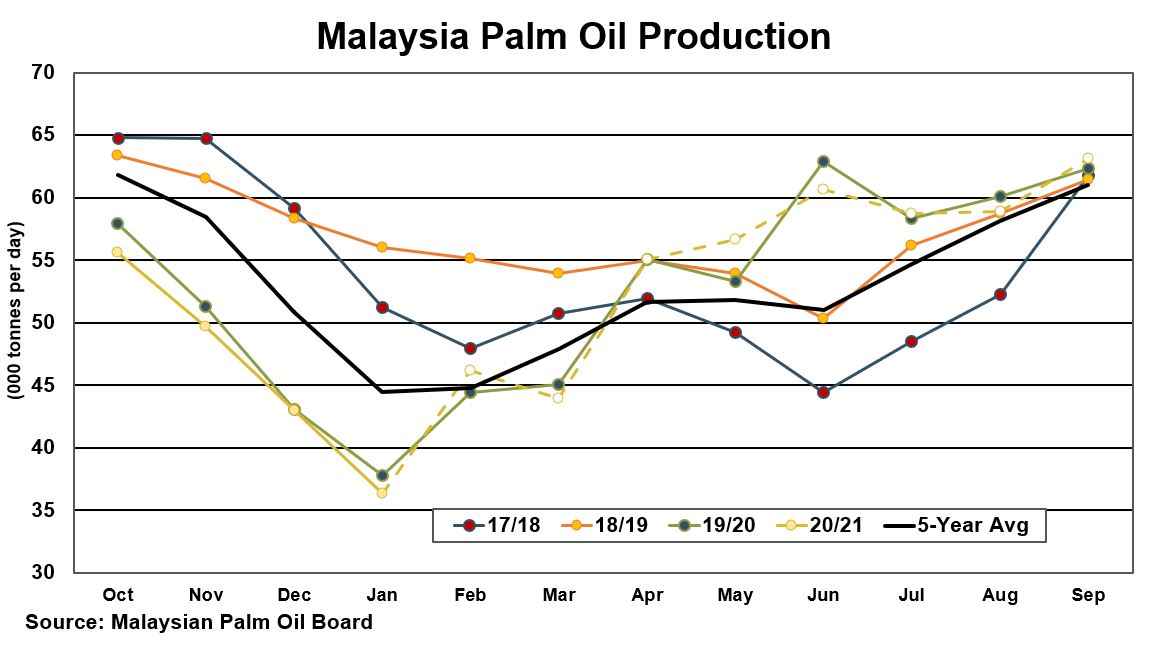

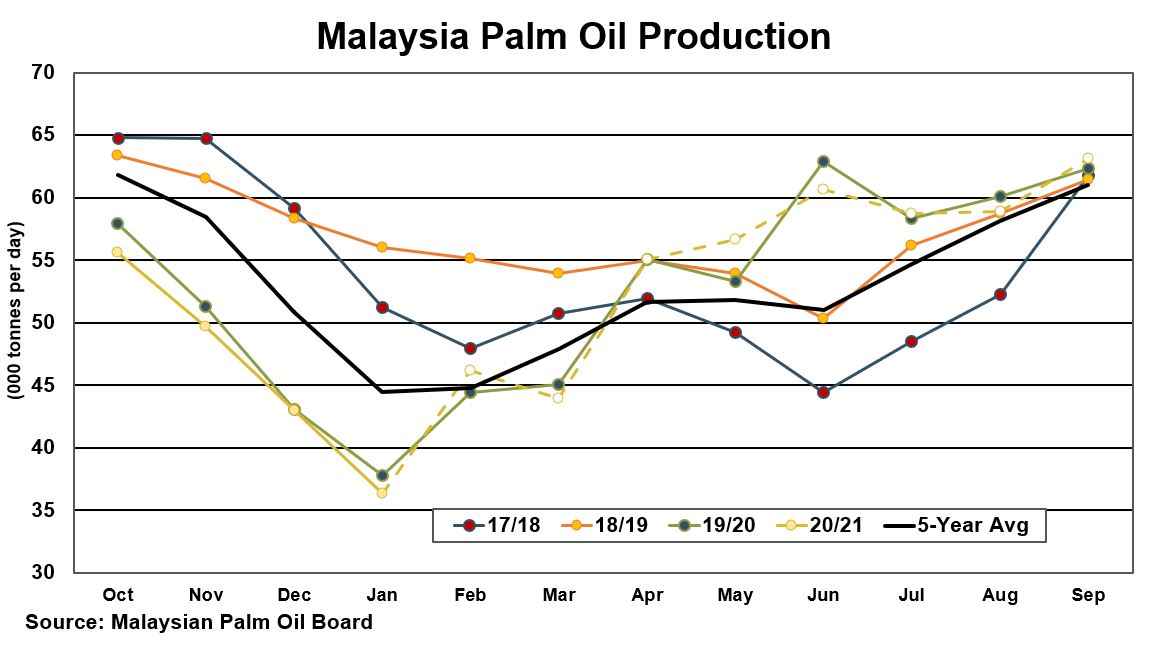

Palm oil contracts declined by about one percent (May contract -42 ringgit per tonne). However, the benchmark contract found support just above the 3,700 ringgit level and remains in the channel between the upper Bollinger band and the five-day exponential moving average. The channel continues to trend higher, suggesting support for further gains, at least in the short term. That said, a slowdown in export demand or larger-than-expected production could raise downside price risks. Palm oil production will likely rise in February from January, but the higher production does not necessarily indicate output is entering the seasonal increase. Localized flooding and excessive rainfall in January reduced output. Production typically starts to rise in March or April, so rising palm oil stocks and increasing downside price risk are not like to become a substantial risk for another month or so.