Please Note

Summer Weight Change Goes into Effect Tomorrow

Every year on April 1 the Price Guide is modified to reflect lighter summer weights. Tomorrow, some selections will go to “0” and it will take at least a week to build up a weekly comparison price. Reports from last week will be carried over to appropriate weight selections as applicable.

For reference, the summer weight ranges in pounds for CBS, BBS, and HNS are 57-61, 61-66, and 66+. BS and HTS are 57-66 and 66+. All heifers and cow weight ranges are 47-53. The summer range for bulls is 90-110 and for dairy steers is 66 and down. Kip skins and small packer hides are unchanged.

If you need a weekly comparison price and do not have hard copies of the daily price sheets, go to Price Guide & Commentary in the ribbon above and when the drop-down appears,” click on “Archives.” Please keep in mind that the reported weight ranges in the archives are the heavier winter weights.

The Price Guide will once again be modified on October 1 when we switch back to winter weights.

Prices increases for lower quality hides are slowing. Sellers interested in lower quality material are hesitant to increase prices much further in understanding the risk of possible pullback from buyers. Premium product from big packers, such as Branded Steers, continues to be offered at higher prices. There are fewer buyers in the market this week, but those who are active are willing to pay more for the premium material.

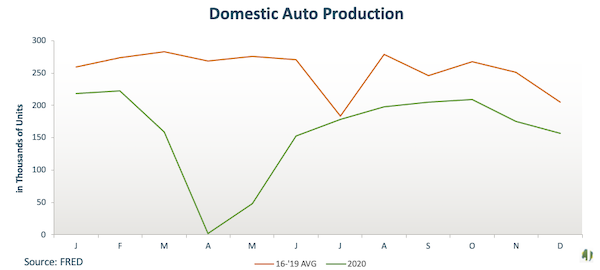

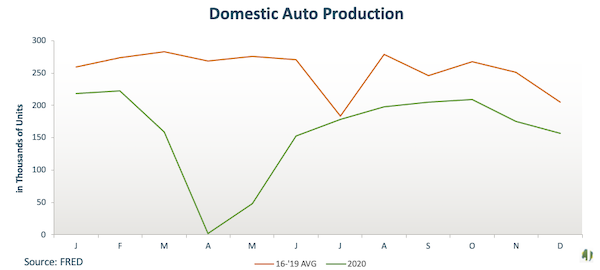

Domestic auto production slid again in February, falling 11 percent from January to 140 thousand units. Federal Reserve Economic Data (FRED) reported production was off 37 percent from the prior five-year average for January and 47 percent for February. The lower production can be partly attributed to the semiconductor chip shortage caused by high demand from production for phones, computers, and vehicles. The Biden administration recognized the global issue and signed an executive order last week to review US supply chains in the semiconductor industry. If logistics improve, it is reasonable to expect an uptick in domestic vehicle production. However, shipping congestion continues to add risk to a full production recovery.

Automotive hide tanners expressed their concern in regard to the disruption tied the chip shortage, but the demand for upholstery continues to be strong. Hides used in this industry have soared above pre-COVID levels, with prices now over $50 per piece for Heavy Native Steers, up 25 percent from the start of February 2020.

Figure 1.

The International Market

Europe

The European hide market is quiet and the number of trades closed over the last two weeks is on the low side. Some of the most important tanneries in the area are now working only three to four days a week due to a general slowdown in demand compared to the beginning of the month. Next week will be short due to the Easter holiday, so the following week may provide what direction the market will take.

Tanneries specialized in leather goods and footwear production report a slight increase of orders for finished leather. This comes after months of very disappointing business for the sectors. Fashion brands have closed some good sales in the Far East over the last few weeks while the European and American market remain under pressure. This is not unexpected, considering that COVID-19 related restrictions are still in place in those areas.

As a result, asking prices for European calf have increased by average 0,20€.

Automotive production is steady and the prices of involved material (especially cow and bull hides) are reported average 0,05€ higher compared to what previously reported.

In general, the total number of items available on the European market remains very low compared to pre-COVID levels, due to a constant lack of demand for meat caused by the closure of restaurants.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**

Today’s Trades

Packer Sales

HTS 62/64 @ $40.00

HTS 70 MIN @ $41.00

BS 62/64 @ $38.00

BS 62/64 @ $40.00

BS 70 MIN @ $41.00

HBH 51/53 @ $30.00 OR 0.4500

NHNDC 51/53 @ $36.00 OR 0.5400

SHNDC 51/53 @ $35.00 OR 0.5250

NHNC 51/53 @ $26.00 OR 0.3900

SHNC 51/53 @ $25.00 OR 0.3750

NBC 51/53 @ $25.00 OR 0.3750

SBC 51/53 @ $24.00 OR 0.3600

N Bull 100/120 @ $21.00 OR 0.1900

B Bull 100/120 @ $20.00 OR 0.1825

Processor Sales

HTS 62/64 @ $32.00

HTS 70 MIN @ $31.00

BS 62/64 @ $35.00

BS 70 MIN @ $36.00

HBH 51/53 @ $22.00 OR 0.3300

NHNDC 51/53 @ $27.50 OR 0.4125

SHNDC 51/53 @ $27.00 OR 0.4050

NHNC 51/53 @ $18.00 OR 0.2700

SHNC 51/53 @ $17.00 OR 0.2550

NBC 51/53 @ $17.00 OR 0.2550

SBC 51/53 @ $16.00 OR 0.2400

N Bull 100/120 @ $16.00 OR 0.1450

B Bull 100/120 @ $15.00 OR 0.1375