06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

The hide market was quiet at mid-week with customers in China holding off on purchases. There was interest from buyers in Korea, but no concluded trades have happened at this point of the week. The selections carrying the most interest were Branded Steers and Dairy Cows with bids at steady to $1 higher.

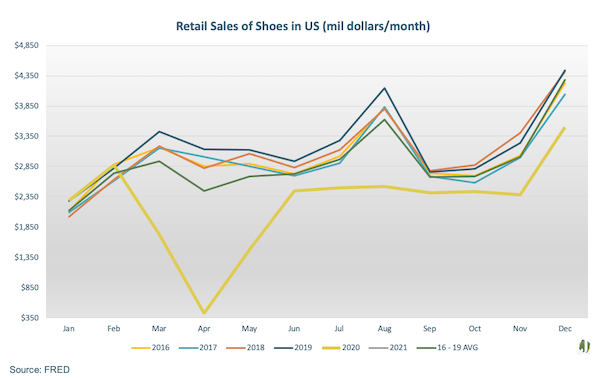

January’s Federal Reserve Economic Data (FRED) retail shoe sales of $2 billion fell 7 percent short of the prior five-year average. Retail sales continue to bounce back from the COVID induced record lows. Historically, December represents a seasonal peak but 2020 sales fell 23 percent short of the prior four-year average. There is optimism that sales will return to more historic norms with vaccination rollouts continuing.

Shipping delays around the world are causing shortages in supply for raw material and shoe retailers. Hide tanners in the footwear industry have been forced to purchase farther ahead in an effort to hedge against raw material shipping delays of an additional 6 to 7 weeks. Despite demand for the raw material, these delays are causing uncertainty in the hide market. In the past month, buyers for raw material were driven to purchase because of strong demand and low inventories. Over the month, the Jacobsen Hide Index (JHI) increased to $38.58, up 44 percent. In following historical trends, April represents a demand slowdown for footwear on the retail level and for raw material purchasing for tanning. Historical trends suggest that prices are due to flatten out in the short term.

Figure 1.

No packer sales today.

No processor sales today.

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...