11.21.2025

Sausage casings bulletin, November 21, 2025

...

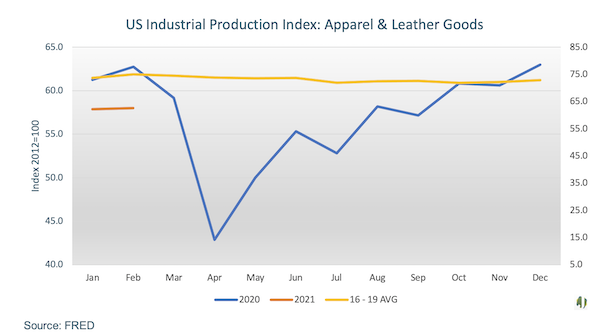

The Federal Reserve Economic Data (FRED) for the US industrial production index for apparel and leather goods was 62.6 points for February, down 14 percent from the prior five-year average for the month. Supply chain complications consisting of shipping delays and material shortages due to COVID-19 interruptions, both restrictions and labor shortages, have contributed to the decreases in industrial production through 2020 and these problems have persisted into 2021. Hide tanners specializing in leather apparel stated that apparel production rebounded along with the global economy upswing toward the end of 2020, but 2021 still lags relative to the pre-pandemic levels. Demand for hides used in leather apparel was aggressive in the first quarter which drove prices up, e.g. Heavy Branded Heifers rose to a packer and processor hide average of $28 per piece-up 87 percent from two months ago. The supply chain issues contributed to an inability for sellers to satisfy the increased demand and so industrial production continued tracking at lower than typical levels. Buyers have increased their purchases in an effort to offset some of the supply chain worries in an effort to build inventory, but this boost in the market is starting to fade with tanners pushing back on prices. Summer hides, which tend to be higher quality than winter, offer some prospect of higher prices but continued disruptions to the supply chain and pushback from the tanners may limit the market upside in the near term.

Figure 1.