11.21.2025

Sausage casings bulletin, November 21, 2025

...

Hide prices traded sideways mid-week, with no changes to previous day price levels. Sellers received bids a few dollars lower than last week’s trading levels. Buyers are pushing for lower prices, citing an increased number of offers in the market. Automotive and furniture upholstery demand continues to be firm and footwear is laggard due to the slower, seasonal demand.

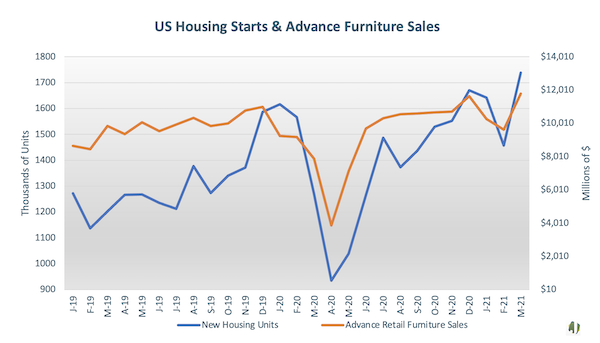

Historically low interest rates have contributed to a surge in new home starts, which has helped to drive furniture demand. The Federal Reserve Economic Data (FRED) reported home starts in March at a 15-year high of 1.7 million. A tight housing market combined with interest rates for a 30-year fixed mortgage as low as 3.27 percent on April 15th have helped to drive the surge in new home construction. On April 27th to the 28th the Federal Reserve’s Open Market Committee set to discuss the state of the interest rate climate. If rates continue at these historic lows, it is reasonable to expect demand for new home starts to continue in the near term. Along with high demand for homes, furniture sales also reached their all-time high in March of $11.8 billion. Among this, leather furniture demand remains firm. A US hide tanner in the furniture sector stated “We have seen steady demand with sustained price increases at the end of the first and into the second quarter on Native and Dairy Cow hides. Prices have begun to stabilize, but we’re continuing to see sizable demand”. The pace of rising hide prices used for furniture have slowed in the past two weeks along with the overall hide market. The current off of the floor price levels have allowed for profitability for hide suppliers and haven’t deterred buyers. Continued new home starts provide an avenue for increased furniture demand.

Figure 1.

No packer sales today.

No processor sales today.