Soybean Oil Prices Set New Highs Despite Bearish Data

Vegetable oil futures were mixed on Tuesday as reports suggesting Indonesian palm oil production could rise by more than seven percent in 2021 weighed on palm oil prices. Meanwhile, despite a bearish Crop Progress report released after Monday’s close, soybean futures gained about one percent, contributing to strength across the oilseed complex. The buying drove soybean oil prices sharply higher, with most contracts settling at new life-of-contract highs and above the intraday high set last Tuesday.

On Monday, the United States Department of Agriculture (USDA) reported farmers had planted 24 percent of the U.S.soybean crop as of May 2. The total was well above the five-year average of 11 percent and above the 11 percent reported for the same day last year. The rapid planting pace could allow farmers to plant significantly more acreage than indicated in USDA’s Prospective Plantings report, released on March 31. Given the rate and the outlook for planting progress over the next two weeks, The Jacobsen believes farmers could plant one million more acres than the 87.6 million indicated in March.

On Tuesday, the Census Bureau released its monthly report with U.S. trade flow data for March. The Census Bureau reported U.S. soybean oil imports totaled 21.3 million pounds, down slightly from 21.4 million pounds in February and below the 31.6 million pounds anticipated by The Jacobsen. Imports of soybean oil from Argentina rose to 61,377 pounds from 43,696 in February. Over the last six months, the U.S. has imported 310,369 pounds of soybean oil from Argentina, less than the 564,611 pounds imported from Canada, and 472,876 pounds from Mexico in March.

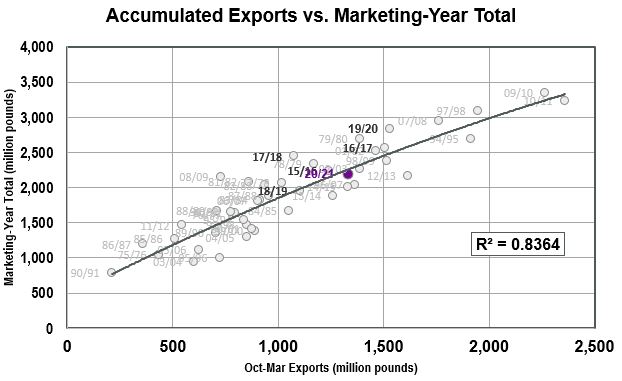

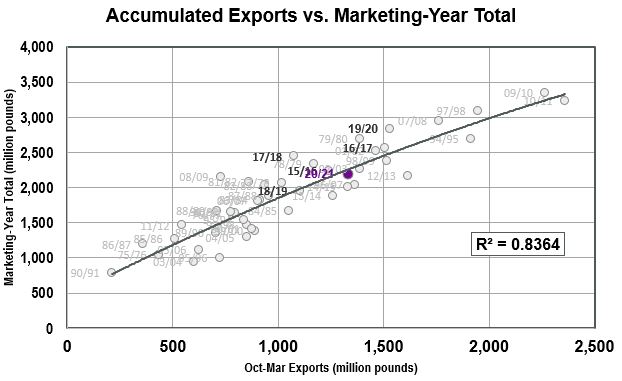

Soybean oil exports totaled 154.8 million pounds, down sharply from the 255.1 million exported in February, well below the 319.8 million pounds shipped last year and the 170 million pounds predicted by The Jacobsen. It was the lowest monthly total since the U.S. exported 124.6 million pounds in January 2020. Guatemala (40.8 million pounds), South Korea (29.2 million pounds), and Venezuela (26 million pounds) accounted for more than 60 percent of the total. Cumulative soybean oil exports through March totaled 1.33 billion pounds, down more than 13 percent from 1.53 billion pounds last year.

The recent decline in export sales drove The Jacobsen to lower its 2020/21 U.S. soybean oil exports 200 million pounds to 2.2 billion. However, the export sales data suggests exports could fall to as low as 1.9 billion pounds. If export sales remain well below the five-year average in the coming months, The Jacobsen will likely make additional cuts to its prediction, but export shipments through March support The Jacobsen’s more modest reduction in its marketing-year forecast.

Most soybean oil contracts gained more than 1 3/4 percent (July contract +52 basis points per pound), but a decline in the May contract weighed on the front end of the curve (December contract +119 basis points). Selling at the 65-cent level in the benchmark contract limited gains while buying just below the 63-cent level limited overnight weakness. Nearby contracts remained between the five-day exponential moving average and the upper Bollinger band, while some deferred contracts settled above the upper Bollinger band. Typically settling above that level would suggest the potential for profit-taking, but given the rally’s strength over the last three weeks, any setback is likely to be short-lived.

Most palm oil contracts were marginally lower (July contract -19 ringgit per tonne), but the declines in the nearby and deferred contracts were slightly more significant. Buying in the benchmark contract at the five-day exponential moving average and below the 4,000-ringgit level limited the decline. Despite two of the largest single-day gains in the last year occurring in the previous week, palm oil prices have mostly remained range-bound, with the benchmark contract trading between 3,850 and 4,100 ringgit. The sideways movement of palm oil and continued gains in soybean oil have pushed the spread between the July contracts up above 19 cents, while the September spread settled just below 16 cents. Ultimately, the spreads will probably narrow. However, unless there is a sharp decline in soybean futures, it seems more likely palm oil prices will need to rise to narrow the spread than soybean oil futures dropping. World vegetable oil fundamentals remain bullish, but seasonally increasing palm oil output is likely to weigh on palm oil prices unless exports offset the increase in output, which may be possible given the spreads. In the short term, the palm oil market will probably continue to trend higher, but traders may wait until the monthly Malaysian Palm Oil Board (MPOB) report before triggering the next leg of the rally.