11.21.2025

Sausage casings bulletin, November 21, 2025

...

Vegetable oil prices were higher on Wednesday as overnight gains in palm oil and a rally in soybean futures drove gains in soybean oil. However, prices rallied ahead of the United States Department of Agriculture’s (USDA’s) projections, and futures were unable to capture the pre-report highs following the release of the data. The rally in palm oil futures left the benchmark contract above 4,500 ringgit for the first time as traders anticipated bullish USDA data ahead of a public holiday that will keep the market closed through the weekend. Overnight gains in vegetable oil prices on the Dalian exchange and bullish import data from India also contributed to the bullish tone in the palm oil market.

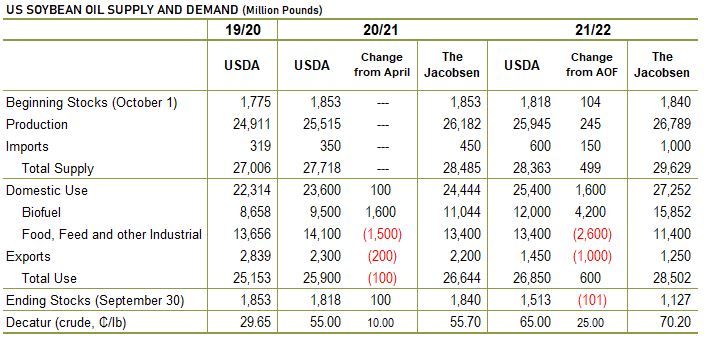

USDA released its World Agricultural Supply and Demand Estimates (WASDE) report on Wednesday. It was the first edition of the report to feature USDA’s 2021/22 projections and its new format for reporting soybean oil use in biofuel production. USDA’s initial prediction of soybean oil used in biofuel production in 2020/21 of 9.5 billion pounds was 1.6 billion pounds above its prior prediction of soybean oil used in biodiesel production. USDA offset the increase with a 1.5-billion-pound reduction in its forecast of non-biofuel usage, providing its forecast of soybean oil used in renewable fuel production other than biodiesel. The 100-million-pound difference between the changes suggests it increased its forecast of soybean oil used as a feedstock in biofuel production from last month by that amount. USDA’s forecast of 12 billion pounds for 2021/22 soybean oil used in biofuel production was 4.2 billion pounds above the Agricultural Outlook Forum (AOF) forecast of usage in biodiesel production of 7.8 billion pounds. However, it only reduced its prediction of non-biofuel use by 2.6 billion pounds, indicating its AOF forecast of soybean oil used in renewable fuel production outside of biodiesel production. The 1.6-billion-pound difference between the AOF forecast and the WASDE projection suggests USDA raised its prediction of soybean oil used as a biofuel feedstock by that much from its AOF prediction.

Beyond the changes to USDA’s biofuel projections, the other differences from USDA’s April WASDE and its AOF predictions were generally in line with The Jacobsen’s projections. USDA raised its prediction of marketing-year average crude soybean oil prices in central Illinois by 10 cents per pound for 2020/21 to 55 cents, 0.7 cents below The Jacobsen’s prediction. USDA increased its price forecast for 2021/22 by 25 cents from its AOF projection to 65 cents, a little more than five cents below The Jacobsen’s prediction of 70.2 cents.

USDA also cut its predictions of U.S. soybean oil exports for 2020/21 by 200 million pounds and for 2021/22 by one billion pounds. The changes left its 2020/21 prediction at 2.3 billion pounds, 100 million above The Jacobsen’s forecast of 2.2 billion, and reduced its 2021/22 projection at 1.45 billion pounds, 200 million above The Jacobsen’s 1.25 billion pound prediction.

The changes raised USDA’s 2020/21 U.S. soybean ending stocks forecast to 1.82 billion pounds, 22 million below The Jacobsen’s forecast of 1.84 billion. USDA’s 2021/22 ending stock forecast of 1.51 billion was 386 million pounds above The Jacobsen’s forecast of 1.13 billion.

Soybean oil futures with 2020/21 deliveries gained more than two percent (July contract +160 basis points per pound). However, gains in deferred contracts were smaller, and some 2021/22 contracts ended the day marginally lower. Selling just below the 67.5-cent level in the benchmark contract limited its advance and left it to settle about one cent below its high. Given that the WASDE report was pretty neutral for the soybean market and meteorologists predict generally favorable conditions for planting progress over the next two weeks, there is some increase in the downside price risk for soybean oil prices. However, USDA’s WASDE report should be generally supportive for 2021/22 prices, suggesting any sell-off in the deferred contracts could be an opportunity for end-users to extend coverage.

Palm oil futures gained more than three percent (July contract +156 ringgit per tonne) ahead of the long holiday weekend. Concerns about labor shortages at palm plantations and surging export demand continue to support prices. However, data from the Solvent Extractors’ Association (SEA) in India also drove buying. The SEA’s monthly report indicated an increase in palm oil imports of 82 percent from last year as buyers substituted palm oil for more expensive soybean and sunflower oil. The coronavirus outbreak in India could limit Indian vegetable oil purchases through the summer. Still, the historically wide spread between palm oil and soybean and sunflower oil suggests palm oil will continue to capture a majority of the market share, even if total purchases shrink.