06.27.2025

Sausage casings bulletin, June 27, 2025

Runner market commentary

...

Vegetable oil prices pushed higher again on Thursday, with hot weather outlooks and bullish supply data boosting U.S. soybean oil futures to their highest close in five weeks. Continued forecasts for dry and hot weather in the Corn Belt through the end of July sent soy oil prices higher in early trading. Fund oil/meal spreading and bullish data released by the National Oilseed Processors Association (NOPA) that showed soy oil stocks fell to their lowest level in eight months in June also pushed benchmark soy oil futures about 1 2/3 percent higher at the close (August contract +109 basis points per pound). Most deferred contracts saw smaller gains in percentage terms due to bull spreading (January 2022 contract +64 basis points per pound).

NOPA said soybean oil stocks among NOPA members dropped to 1.537 billion pounds, down eight percent from May. U.S. soybean crushing volumes among members fell 6.8 percent in June to their lowest level in two years to 152.41 million bushels, from 163.521 million bushels in May and well below average market expectations of about 159 million bushels. To account for the slowdown in crushing, the United States Department of Agriculture (USDA) earlier this week cut its 2020/21 marketing year U.S. crush forecast by five million bushels. The lower-than-expected U.S. soybean crush for June and the ongoing decrease in monthly soybean oil stocks should provide near-term upside support for soybean futures prices.

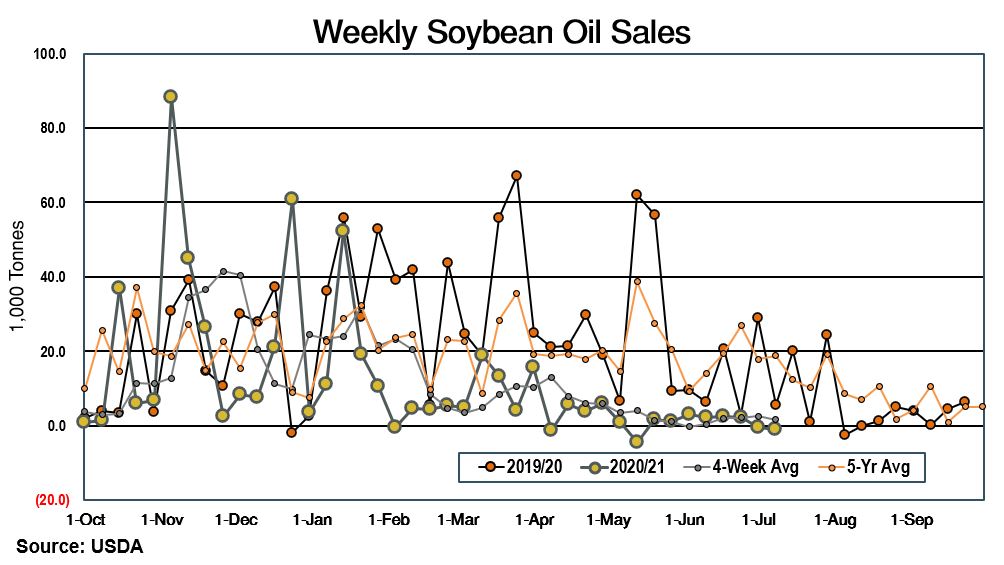

The market also digested the latest Weekly Export Sales Report released today by USDA. For the week ending July 8, USDA reported a net reduction of 900 tonnes in U.S. soybean oil sales to Canada. The decline left outstanding soybean oil sales at 19,100 tonnes, down almost 10 percent (2,100 tonnes) from the week prior and down 92.1 percent (223,700 tonnes) from the same week the year before.

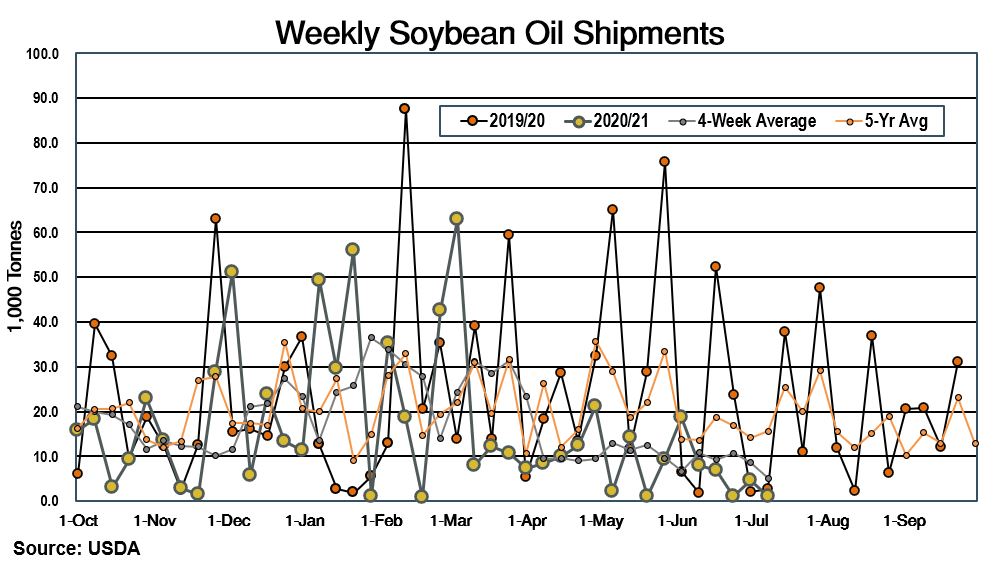

USDA said weekly export shipments decreased 75 percent from the prior week and 78 percent from the four-week average to 1,100 tonnes. Export destinations were Mexico (600 tonnes) and Canada (500 tonnes). Cumulative soybean oil exports totaled 657,400 tonnes, down about 33 percent (323,700 tonnes) from the same week a year earlier.

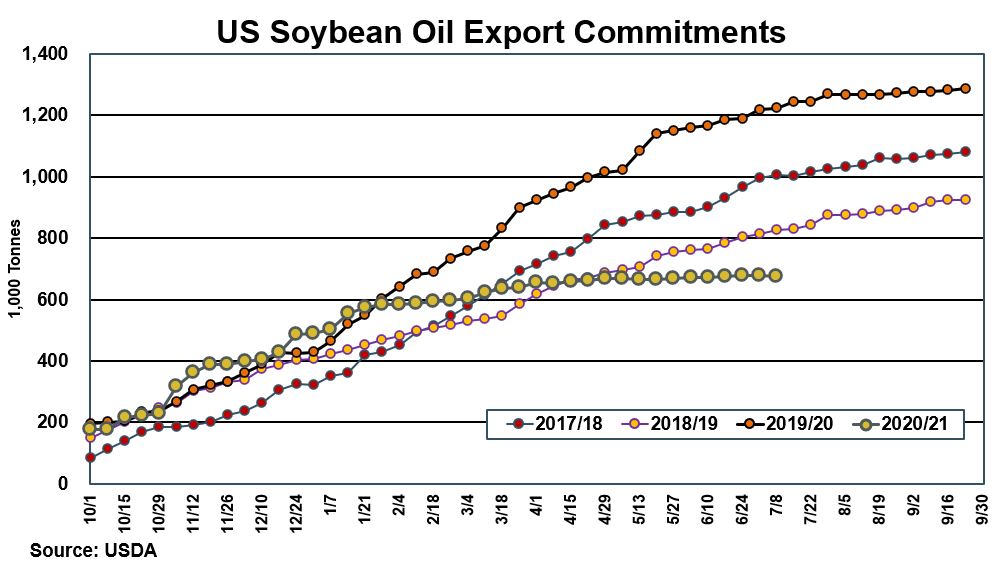

Commitments for 2020/21 were down to 676,600 tonnes, which is 44.7 percent (547,300 tonnes) below the same period last year.

Palm oil futures in Malaysian rose to their highest level in six weeks, due to a weaker ringgitt, stronger edible oil prices on the Dalian, production concerns, and rising exports. According to cargo surveyor data for July 1-15, Malaysia’s exports climbed about five percent, compared to market expectations for an increase of as much as 3 1/2 percent. Nearby palm oil futures held above the psychologically significant level of 4,100 ringgit per tonne to end almost 3 4/5 percent higher (September contract +152 ringgit per tonne). Gains for deferred palm oil futures contracts were smaller on Thursday, coming in about two to three percent higher (March 2022 contract +114 ringgit per tonne).

06.24.2025

Correction to sausage casings, resale, North American hog runners, whiskered, ex-works North America on June 20: pricing notice

North American hog runners price published on Friday was incorrect due to a formula miscalculation. The original reported price of $1.63 has been corrected to the accurate rolling average...