11.21.2025

Sausage casings bulletin, November 21, 2025

...

Used Cooking Oil – Delivered Gulf

Pricing is for spot and forward sales (30 – 90 days in the future) of Used Cooking Oil (UCO) in rail cars at a price negotiated relative to a delivered Gulf (New Orleans, LA area or Houston, TX area) value. UCO can be traded as packer or renderer specification. Price discovery falls within our printed methodology. Minimum volumes and specifications have been determined by discussions of market participants and with guidance from the specifications within the market trade associations

Price: US Cents per pound

Cargo Size: Minimum of 5 rail cars

Timing: Shipment date outside of 30 days of sale for forward sales, shipment within 30 days of sale for spot market.

Assessment: Monday – Friday until 3:00 pm CT. Any trades confirmed after 3 pm CT are reflected in the following day’s price guide. From the Friday after Memorial Day until the Friday before Labor Day, the Friday close of trade is 12 noon CT.

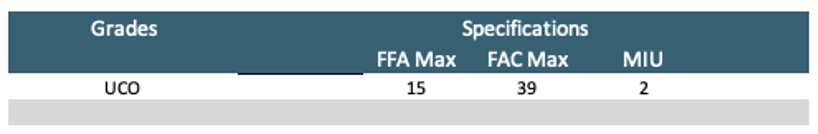

Specifications for Used Cooking Oil are as follows:

To ensure that The Jacobsen is capturing accurate values in what can be an illiquid market, The Jacobsen takes into account trades, bids and offers from the market as a whole on each given day. Trading takes priority in price reporting and in the case of multiple price points, The Jacobsen will print a price spread as long as the high and low are within 5 percent of each other. In the instance of a wider price spread, volumetric considerations are used to determine a price as well as the hierarchy of price exclusions. Price spreads of greater than 5 percent can be included in the price guide after a peer review process.

To ensure that The Jacobsen is capturing accurate values in what can be an illiquid market, The Jacobsen takes into account trades, bids and offers from the market as a whole on each given day. Trading takes priority in price reporting and in the case of multiple price points, The Jacobsen will print a price spread as long as the high and low are within 5 percent of each other. In the instance of a wider price spread, volumetric considerations are used to determine a price as well as the hierarchy of price exclusions. Price spreads of greater than 5 percent can be included in the price guide after a peer review process.

Trade values need to be repeatable across the market.

All buyers are eligible to bid a market higher or offer the market lower as all sellers are able to offer product lower and bid the market higher. The bids and offers must be made to the market as a whole and are subjected to scrutiny by the PRA assessors to determine if the value is an economic reality.

All transactions must be made at arm’s length.