11.21.2025

Sausage casings bulletin, November 21, 2025

...

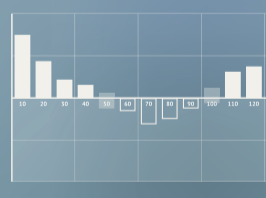

70,375 credits traded on only eight transactions. This was the lowest number of trades since November of 2017. The average price paid per credit edged higher, moving up to $185 from $183. Second quarter credit volume is 27 percent over first quarter volume but down 12 percent compared to the second quarter of 2018. Weekly credit volume increased 30 percent but is down 68 percent from the same weekly period last year. Average weekly credit volume decreased from 205,762 to 198,982.

Trading activity was heaviest on Monday May 13, with 43 percent of the trades taking place. The highest average daily price was $187, which occurred on Friday. The price range credits traded in narrowed from $100 – $188 the week prior to $176.5 – $195. The weighted-average credit price was $185.20, up two dollars from the week prior. At the top of the range 5,000 credits traded and 2,875 traded at the bottom of the range. 53 percent of the credits traded at a price of $185 or above, 4 percent traded below $180.

The Jacobsen expects credit volume to continue to rise relative to last year. An additional 284 million gallons of biodiesel and renewable diesel are forecast to be produced during 2019. There were 11.18 million LCFS program credits generated during 2018 and there are 13.7 million forecast for 2019.

CARB only includes transfers that are completed in the given week. Transfers for future dates, proposed and still pending confirmation, are excluded. CARB’s weekly report excluded 5 transfers of 52,632 credits. CARB will exclude transfers that trade at, or near, zero in price.

May 20 (Biomass Magazine) Court rejects ABFA request for injunction on SREs – The U.S. Court of Appeals for the District of Columbia Circuit on May 17 denied a motion filed the Advanced Biofuels Association last month seeking a preliminary injunction preventing the EPA from granting any additional small refinery exemptions (SREs) under the Renewable Fuel Standard until its pending lawsuit with the agency is resolved. READ MORE

May 17 (dtnpf) Court Rejects Biofuels Group Request for Injunction on Small Refinery Waivers – A federal court Friday denied a motion for an injunction against EPA from approving additional small refinery waivers, using what the agency said is a new process for issuing those waivers to the Renewable Fuel Standard. READ MORE

May 02 (Ethanol Producer Magazine) Letter asks EPA to use RFS reset rule to lower ethanol RVOs – A group of 15 senators, led by Sen. Jim Inhofe, R-Okla., sent a letter to U.S. EPA Administrator Andrew Wheeler April 30 asking him to use the agency’s upcoming Renewable Fuel Standard reset rule to limit future renewable volume obligations (RVOs) for conventional biofuel to less than 10 percent of projected gasoline demand. In response to Inhofe’s letter, the Renewable Fuels Association is calling on the EPA to use the RFS reset rule to reallocate lost volumes associated with small refinery exemptions (SREs) and increase conventional biofuels beyond 15 billion gallons annually. READ MORE

I always look forward to hearing from our customers. Please feel free to contact me with any questions, comments, or suggestions you may have. If you buy, sell, or trade any of our products, I would like to hear from you. Bob Lane at [email protected] 847-549-3640.