11.21.2025

Sausage casings bulletin, November 21, 2025

...

Europe

According to several reports received from operators who attended the fair, the All China Leather Exhibition gave some interesting insights regarding the actual state of the leather market. On one hand, an acceptable number of trades of non-European hides has been closed. On the other hand, it appeared that European hides are still under pressure, especially compared to US and South American material. At the moment, all operators’ eyes are on the upcoming Lineapelle fair in Milan, even though it’s hard to believe that a trend change will be seen in a short time.

Slaughterhouses and packers tested the strength of the demand by increasing their asking price, but apparently most of these requests have been refused. Buyers are still bidding low, and in the end some trades were closed for prices which are very close to the ones reported two weeks ago.

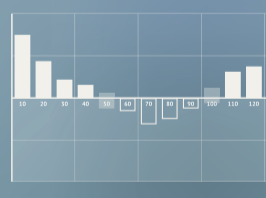

German bulls, French cow and Dutch calves are all reported steady, as well as Italian calves and Polish heifers. German cows are down €0,05, and French calves are down €0,10.

This means that prices are basically steady since July, which supports the impression that rock bottom has been reached. This is surely good news, but until orders for finished leather significantly increase, it is unlikely that the market will rebound.

In this sense, it is important to keep an eye on how the European economic situation will evolve in the upcoming months. Mario Draghi, president of the European Central Bank, asked the leading European countries to increase investment in order to boost the industrial production and put a halt to the possible recession that might hit Europe. If this crucial target will be reached, it is possible that a change of market sentiment will be seen. Should this not be the case, it is probable have that the wait will be much longer for it to happen.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**

Sep. 8 (Drovers) US — Packer/Feeder Margin Spread Now Exceeds $600 Per Head

Losses continued to grow for feedyards and the spread between feeder losses and packer profits only widened with a $1.50 per cwt. decline in cash cattle prices last week. Packers bought the few cattle they needed at an average of $100.70 per cwt., leaving feedyard margins at a negative $203 per head. Packer margins held mostly steady at a historic $415 per head, leaving the spread between feeder losses and packer profits at $618, according to the Sterling Beef Profit Tracker. READ MORE

USDA Hides and Skins Report

Net sales of 464,200 pieces reported for 2019 were up 38% from the previous week and 39% from the prior four-week average. Whole cattle hide sales totaling 465,700 pieces were primarily for China (312,700 pieces, including decreases of 6,000 pieces), South Korea (49,800 pieces, including decreases of 2,400 pieces), Mexico (42,000 pieces, including decreases of 500 pieces), Brazil (29,200 pieces), and Thailand (12,400 pieces, including decreases of 700 pieces). Exports of 534,000 pieces reported for 2019 were up 68% from the previous week and 38% from the prior four-week average. Whole cattle hide exports of 525,800 pieces were primarily to China (271,000 pieces), South Korea (118,400 pieces), Mexico (61,000 pieces), Thailand (43,800 pieces), and Taiwan (9,700 pieces).

Net sales of 142,000 wet blues for 2019 were up 42% from the previous week and 80% from the prior four-week average. Increases primarily for Vietnam (77,500 unsplit and decreases of 200 grain splits), Italy (44,900 unsplit), China (18,500 unsplit), Brazil (1,800 unsplit), and India (1,000 unsplit), were partially offset by reductions for Mexico (1,600 unsplit). For 2020, total net sales of 60,000 wet blues were for Italy. Exports of 144,200 wet blues for 2019 were up 7% from the previous week and 3% from the prior four-week average. The primary destinations were China (45,200 unsplit), Italy (40,600 unsplit and 1,800 grain splits), Vietnam (30,300 unsplit), Thailand (16,300 unsplit), and Mexico (2,400 unsplit and 2,000 grain splits). Total net sales of splits, 1,700 pounds for 2019, were reported for Vietnam. Exports of 204,400 pounds were to Vietnam (161,400 pounds) and China (43,000 pounds).

Link to Complete USDA Report: EXPORT-SALES/HIDESFAX

Hide prices are mostly unchanged on limited trading with some signs of backing off on several recent trades. Suppliers report most bids are off around a dollar, but some buyers have been willing to take steady from a week ago. China will be celebrating the Communist Party’s 70th anniversary October 1 during their National holiday. Tanneries will be closed from one-two weeks in most of the country and up to four-six weeks in the North Hebei area, subsequently subduing hide market activity during that period.

USDA Cure Hide and Wet Blue Export Sales Recap:

For week ending September 12, cured hide and wet blue sales increased 39.7% to 607,636 from 434,902 and shipments increased 48% to 670,073 from 454,528 the prior week. The same week slaughter was 629,000 head with both sales and shipments exceeding production taking domestic consumption into consideration. For comparison, average year-to-date weekly sales are tracking at 532,552, shipments at 542,634 and slaughter at 628,462. Total sales for the last six weeks average is 437,546 and shipments are 552,258. Year-to-date total sales are tracking 0.7% behind the same period last year and shipments are 1% above.

Today’s Market

The day remained on a quiet side with a small number of packer and processor sales quoted. Prices were mixed but close to previous reports.