11.21.2025

Sausage casings bulletin, November 21, 2025

...

The hide market begins the week with minimal business over the weekend. The major buyers in the market right now are the Chinese customers, while Italian tanneries and brands are silent. Lockdowns in Europe have continued talks of market uncertainty in the upcoming months, with many wondering what will come of consumer spending.

No packer sales today.

No processor sales today.

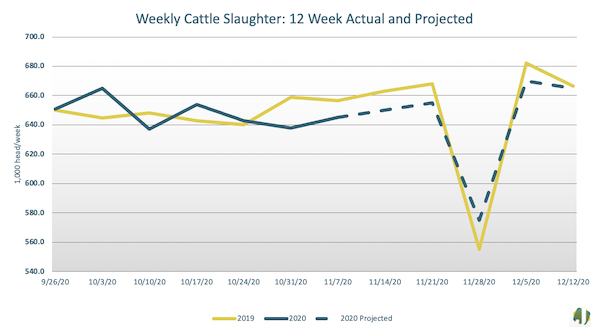

The Jacobsen slaughter forecast for this week is 645,000 head, and if realized, will be 11,700 head less than the same week last year when it was 656,700.

Cattle slaughter finished last week 638,000 head, down 3.2 percent from a year ago. Over the next six weeks, slaughter is forecast at an average of 643,300 head, down an average of 0.7 percent from the prior six weeks and down 0.8 percent compared to last year.

Figure 1.

China

Last week, Chinese buyers are said to have received less offers from the major sellers, including some American packers. Hide prices remained firm again.

Some Chinese buyers are still willing to buy but are very cautious to pay the price and limit the volume of each purchase.

The upholstery type leather business remains fair in China. A few major tanneries are busy as there are still plenty of new orders from Europe and USA.

Meanwhile, more Chinese tanneries have tried to raise the leather price-as they have to do so in order to catch up with the hides price.

At this moment, many Chinese tanners are concerned with the second wave or third wave of the pandemic and if it is to get worse. With this concern in mind, some Chinese buyers prefer to play it safe and stay out of the hides market for now if they find it difficult to get the price they want from the sellers.