11.21.2025

Sausage casings bulletin, November 21, 2025

...

The US hide prices continue to increase with strong leather demand driving the rally. Today, the light-weight heavy native steers (HNS-L) and butt branded steers (BBS-L) increased $0.50 on packer material. Northern branded cows (NBC) have also jumped up $1.50 for the packer selection. Chinese customers continue to be the major player for US steer material, but are not the only buyers willing to pay the increased prices.

HNS 62/64 @ $37.50 OR 0.4650

BBS 62 MIN @ $35.50 OR 0.4475

NBC 52/54 @ $11.00 OR 0.1625

HNS 62/64 @ $29.00 OR 0.3600

BBS 62/64 @ $27.00 OR 0.3350

NBC 52/54 @ $8.00 OR 0.1175

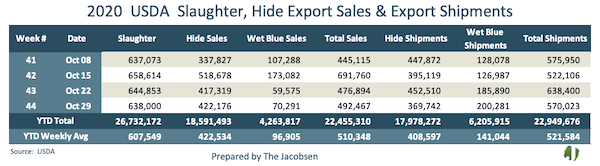

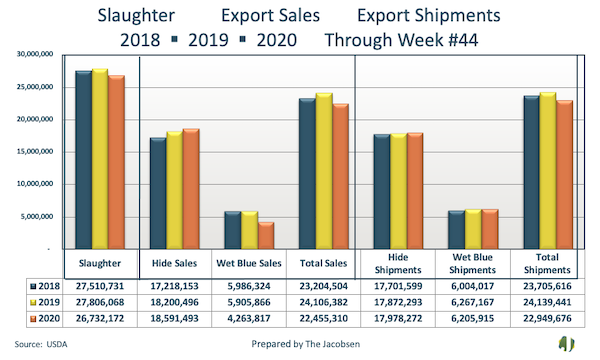

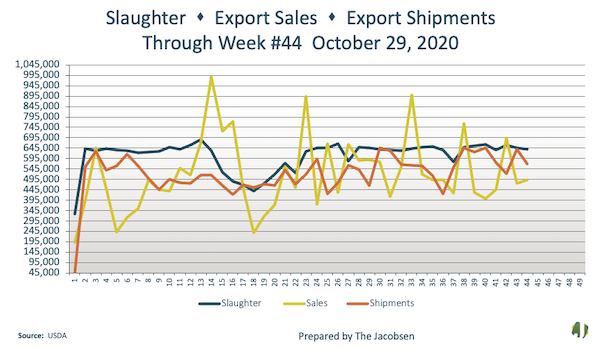

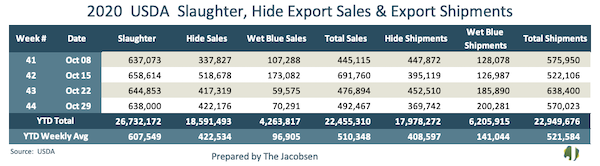

USDA Cured Hide and Wet Blue Export Sales Recap

For week ending October 29, export sales for 2020 marketing year increased 3 percent to 492,767 from 476,894 and shipments decreased 11 percent to 570,023 from 638,400. Sales for marketing year 2020 totaled 22,855,310—mostly all hides. The average year-to-date weekly trends for federally inspected slaughter were 608,049, total export sales were 519,439 and total export shipments were 521,584.

USDA Hides and Skins Report

Net sales of 401,800 pieces for 2020 were down 4 percent from the previous week, but up 3 percent from the prior four-week average. Increases primarily for China (285,700 whole cattle hides, including decreases of 14,900 pieces), South Korea (49,400 whole cattle hides, including decreases of 2,600 pieces), Mexico (33,400 whole cattle hides, including decreases of 600 pieces), Brazil (20,100 whole cattle hides, including decreases of 100 pieces), and Thailand (9,400 whole cattle hides, including decreases of 100 pieces), were offset by reductions for Indonesia (400 pieces), Vietnam (200 pieces), and Japan (200 pieces). For 2021, total net sales of 7,200 pieces were for China. Exports of 374,900 pieces reported for 2020 were down 18 percent from the previous week and 15 percent from the prior four-week average. Whole cattle hides exports were primarily to China (304,400 pieces), South Korea (27,100 pieces), Mexico (15,800 pieces), Taiwan (6,100 pieces), and Indonesia (4,800 pieces). In addition, exports of 5,200 calf skins were to Italy.

Net sales of 70,300 wet blues for 2020 were up 18 percent from the previous week, but down 39 percent from the prior four-week average. Increases reported for China (56,900 unsplit, including decreases of 100 unsplit), Thailand (12,000 unsplit, including decreases of 100 unsplit), Mexico (8,000 grain splits), Brazil (1,800 grain splits, including decreases of 300 grain splits), and South Korea (800 unsplit), were offset by reductions primarily for Vietnam (7,200 grain splits and 1,700 unsplit). For 2021, total net sales of 15,200 wet blues were reported for Vietnam (8,000 unsplit and 7,200 grain splits). Exports of 200,300 wet blues for 2020 were up 8 percent from the previous week and 28 percent from the prior four-week average. The destinations were primarily to Italy (56,400 unsplit and 9,800 grain splits), China (61,300 unsplit), Vietnam (53,100 unsplit), Thailand (5,800 unsplit), and Taiwan (3,700 unsplit and 1,800 grain splits). Net sales of 264,900 splits resulting in increases for Vietnam (270,900 pounds, including decreases of 70,200 pounds), were offset by reductions for China (6,000 pounds). For 2021, net sales of 93,600 splits resulting in increases for China (143,300 pounds), were offset by reductions for Vietnam (49,800 pounds). Exports of 826,600 pounds were primarily to Vietnam (782,900 pounds).

Link to Complete USDA Report: EXPORT-SALES/HIDESFAX

Friday Early Publication Hours in Effect — Friday’s Trade Reporting Deadline 2 p.m. CST

Friday publication hours are in effect. The deadline for trade reporting will be at 2 p.m. CST with publication of the Hide & Leather Price Guide/Commentary soon after.

Argentina

Slaughter remains at quick, but steady pace, mainly on light-weighted cattle which aren’t in much demand. However, heavy raw hides are so the price has risen to Arg. 16 pesos (about US$0.19) per fresh kg and the price for light hides dropped to Arg.$14 (about US$0.17) per fresh kg.

Good quality Buenos Aires wet salted heavy steers are quoting unchanged from last week at about US$0.18 per kg.

The postponed wet salted hides export rate will continue until the end of the year, so wet salted hide exports continue firm.

As for leather demand, there is a lot of uncertainty due to COVID-19 in Europe and in USA, which are Argentina’s main sources of consumption.

Beef Argentine exports continue at a steady pace, with three consecutive months in which 12-month mobile shipments are stable at around 915 thousand tec-a record for several decades.

At this point in the year, it is possible to foresee that 2020 will close with close to 900,000 tec, surpassing last year’s record.

In September, Argentine beef exports totaled 85,000 tons of carcass equivalent (tec), representing growth of 7,000 tec in relation to August and of 3,000 in the interannual comparison. Last August was the first year-on-year decline in more than five years, but has now been reversed.

**Visit our International Hide & Leather Bulletin to see market news for additional countries across globe.**